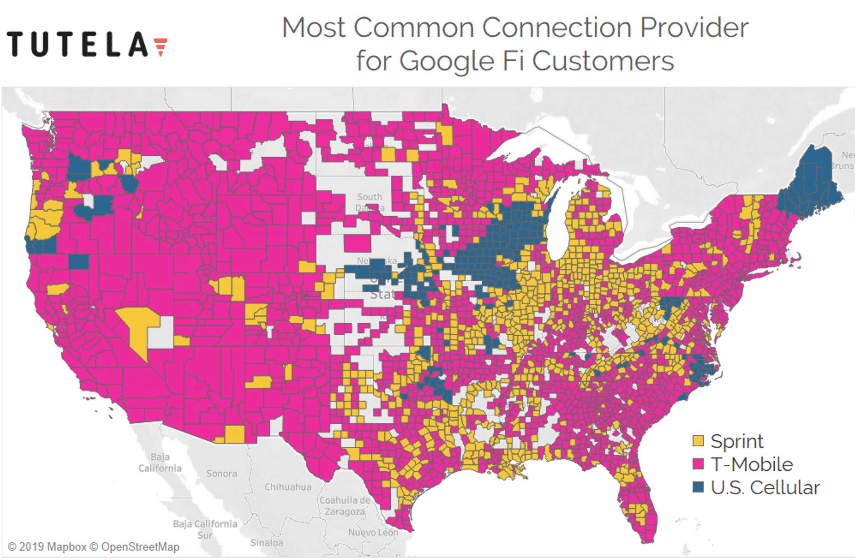

The carrier US Mobile recently released new unlimited plans. As with US Mobile’s old plans, customers can choose either the Super LTE network or the GSM LTE network. Super LTE runs over Verizon’s network while GSM LTE runs over T-Mobile’s network. Plans appear to be priced the same regardless of the network a subscriber chooses.1

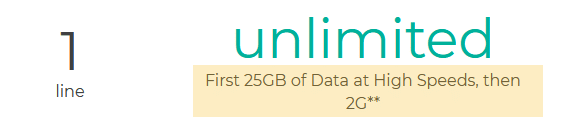

“Unlimited” is a bit of a misnomer for US Mobile’s new plans. The plans have limits, but the limits are dependent on which options subscribers select. Customers can choose either US Mobile’s “Fast” plan or its “Ludicrous” plan.

Limits

As I understand them, here are the limits on the Fast plan (base price of $40 per month):

- Speeds are usually throttled to a maximum of 5Mbps

- If 50GB of data is used in a single month, speeds are throttled intensely (15GB with GSM)

- Hotspot use is not permitted (can be added for an additional $5 per month)

The Ludicrous plan has a base price of $50 per month. The Ludicrous plan does not have a 5Mbps throttle, and mobile hotspot is included. As with the Fast plan, data use beyond 50GB (15GB with GSM) is throttled intensely.

I use the phrase “throttled intensely” because US Mobile doesn’t disclose its policies clearly. On its website, the company writes:

A US Mobile agent I reached out to confirmed that there is a throttle after the threshold level of data use is reached. The agent seemed reluctant to mention a specific speed cap but explained that speeds would feel like 2G. Following the argument I made in Unlimited Plans At 2G Speeds Are Bogus, I think it would be more transparent if US Mobile called their plan a 50GB plan. Extra data at slow speeds could just be a little perk. That said, I understand the carrier caving to the pressure to call its plans “unlimited”.

I don’t love the phrasing of “A tiny fraction of heavier data users may notice reduced speeds.” It seems to suggest that only some of the people who pass the threshold will have reduced speeds. As I understand it, US Mobile is imposing a serious speed cap on everyone who passes the threshold of 50GB. I’d suggest an alternate phrasing along the lines of Heavy data users, who make up a tiny fraction of our subscriber base, will experience substantially reduced speeds after 50GB of use..”

Are The Plans Competitive?

US Mobile’s Super LTE unlimited plans look competitively priced for those who only need one or two lines and want service over Verizon’s network. Large families can probably get better per-line rates by purchasing service from Verizon directly (Verizon drops its per-line rates on unlimited plans as more lines are added).

Unlimited plans purchased from Verizon’s Flanker brand, Visible, may be cheaper than US Mobile’s plans, but regular issues and limited device options with Visible may make US Mobile a better bet.

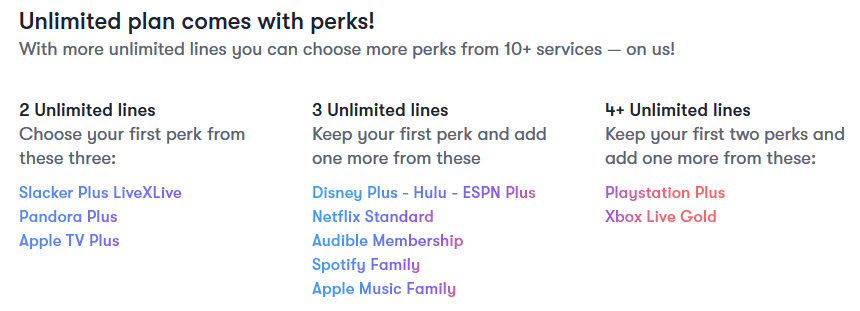

US Mobile also includes some other companies’ services as perks with their unlimited plans. Here’s a screenshot from the carrier’s website:

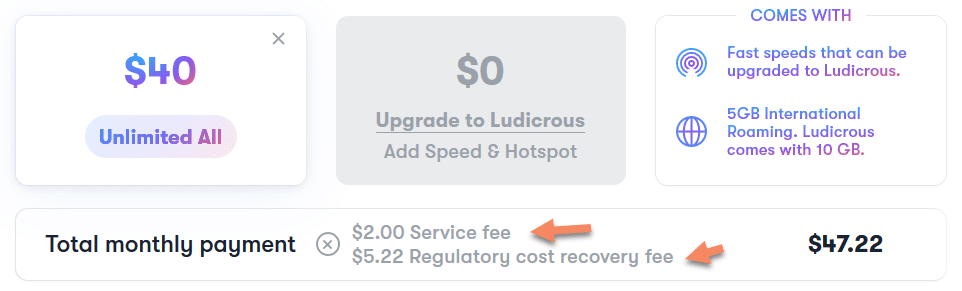

Hidden Fees

On the new unlimited plans, it seems US Mobile is still hiding fees. Most consumers won’t see these fees until after they’ve ordered a SIM card:

Both fees are annoying. One could argue the regulatory recovery fee is at least a fee that many other carriers are also hiding. The $2 per month service fee is unusual.