Last week, Nancy Clark, President of Verizon Value Markets, wrote on LinkedIn about one of the most aggressive promotions I’ve seen in this industry:

At Visible, not only do we provide better value, but we do it 365 days a year. No gimmicks and no hidden fees. Today, we’re giving all T-Mobile single line customers the chance to bring their number over to Visible and get the Visible plan for $15 per month with a 5-year price guarantee, taxes and fees included…Give us a shot and use the code BYEBYETMO for this amazing offer.

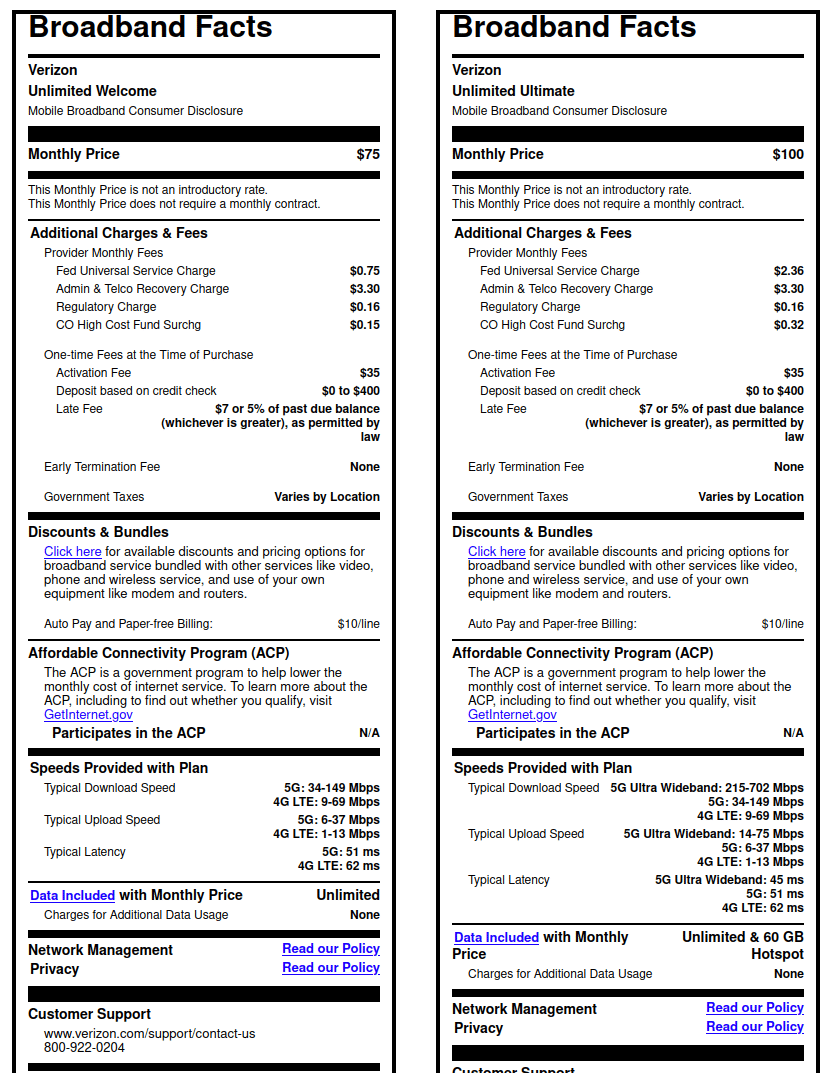

Was Mint being as deceptive as Clark suggests? T-Mobile’s press release about Mint’s promo opens audaciously with this image:

However, a sentence in the first paragraph of the press release clarifies the terms (emphasis mine):

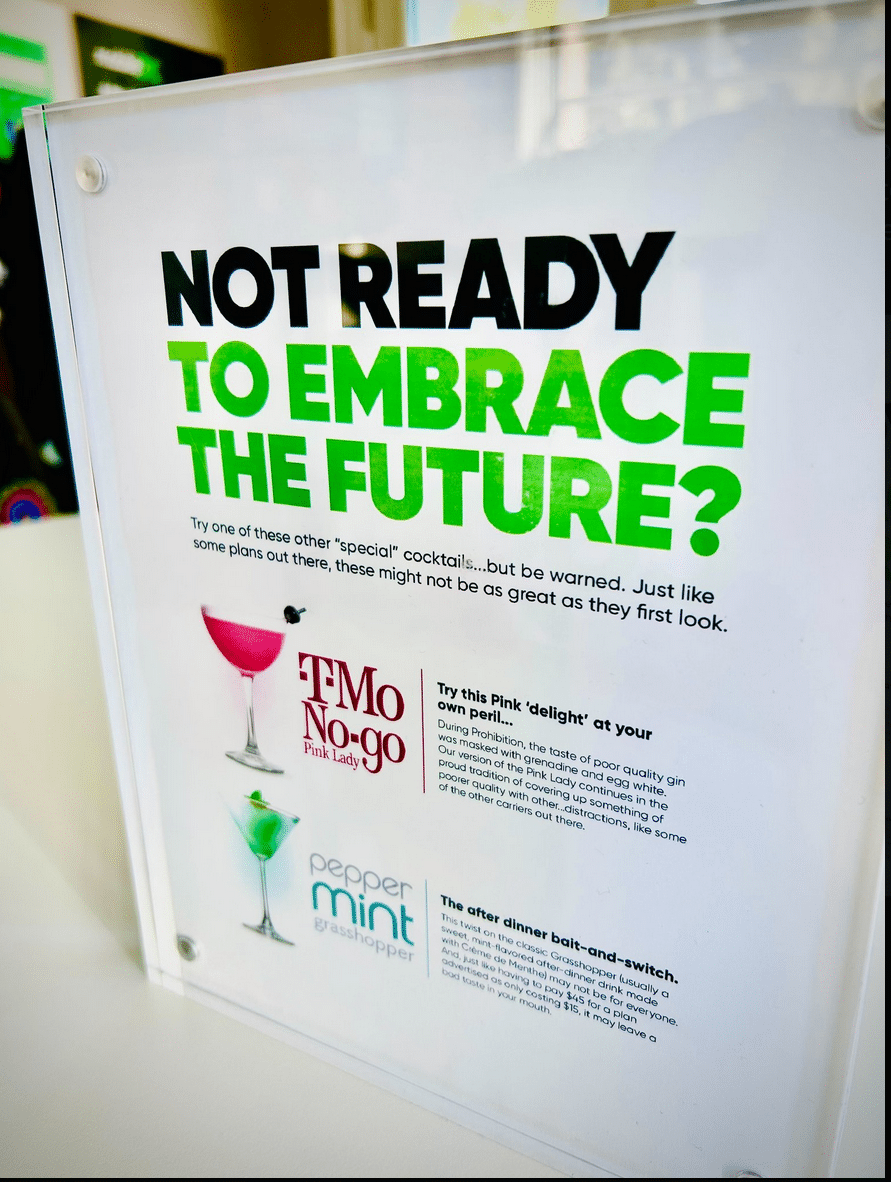

Mint tends to describe its promotions boldly with a headline, then walks back a bit when explaining promotions’ terms. At a recent conference, MobileX took a clever shot at Mint for this behavior:

“The after dinner bait-and-switch…just like having to pay $45 for a plan advertised as only costing $15, it may leave a bad taste in your mouth.”