Earlier this week, US Mobile announced a closed beta for a new, multi-network offering. Here’s the core excerpt from the announcement that Ahmed Khattak, US Mobile’s CEO, shared on Reddit:

With these plans, you can use your unlimited data across multiple networks on a single device that supports DSDS (eSIM/eSIM or eSIM/pSIM). For an additional cost of $15, you can add a line from another network to your device and share your unlimited data seamlessly between both networks.

OS-Level Switching

As far as I can tell, US Mobile plans to rely on the cellular data switching capacities that are available on multi-SIM devices and built into Android and iOS. The approach differs from what we saw with Google Fi’s (now largely abandoned) switching technology that functioned with a single SIM card.

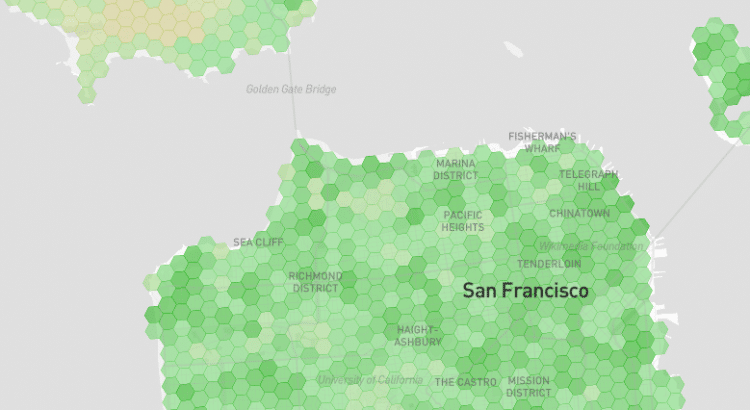

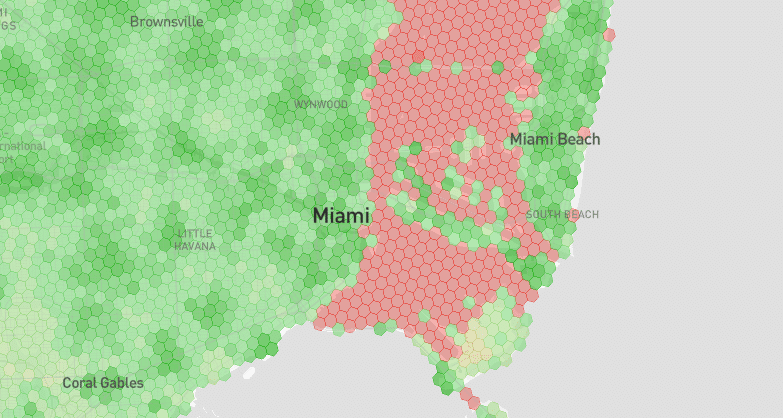

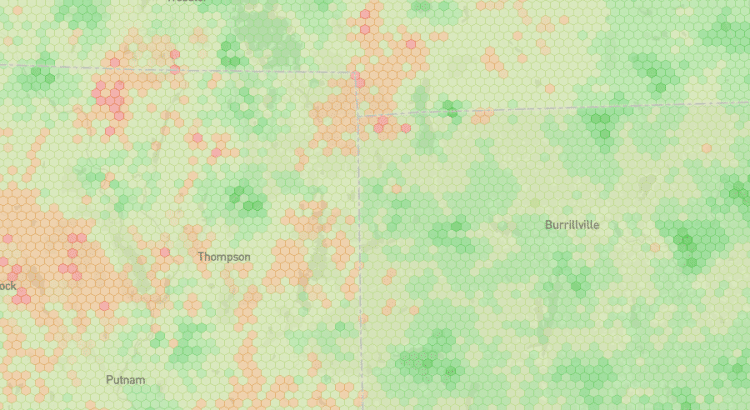

My impression, shared by many Reddit commenters, is that OS-level automated switching between SIM cards is not seamless or optimal. Network switching occurs reliably when an active network becomes unavailable. Switching may occur at other times as well, but the technology falls short of constantly testing both networks and reliably selecting the better network at every moment.

So far, I sound negative. But I’m thrilled about this announcement. While I don’t understand the underlying technology, I expect both Google and Apple will try to improve this technology as more people run muti-SIM setups. I’m glad US Mobile can piggyback on these behemoth companies instead of trying to do tough technical work themselves.

And US Mobile is still pulling off a possibly first-of-its-kind feat in logistics. While users have SIMs on two different networks, US Mobile’s systems can treat this service similarly to to a single plan that draws on one unified pool of data.

Getting Technical

In response to questions from Reddit users, Khattak edited the announcement to add technical details covering how the network switching works:

Subsequently, the estimated link capacity for each network is paired with the device’s data usage, resulting in a congestion ratio representing the ratio of data usage to link capacity for each network. Higher congestion ratio values signify elevated data usage on the respective network and/or comparatively lower link capacity. This indicates a higher likelihood of encountering slower data transfer speeds and diminished performance when utilizing that particular network.

The process of estimating link capacity and device data usage operates over a defined time window, adjustable to accommodate desired sensitivity levels in the estimates. Additionally, a moving average of the congestion ratio is continuously computed for each network, serving as an ongoing reference maintained by the device. This ensures a dynamic assessment of network performance, facilitating informed decisions regarding network switching to optimize the device’s connectivity experience.

I read over that several times, but I may not fully comprehend it. Three metrics are mentioned: (1) data usage, (2) link capacity, and (3) congestion ratio. Link capacity will differ between two networks. While data usage changes over time, I believe it should be the same for both networks at any given moment. Since the congestion ratio is just the ratio of the other two metrics, I think only link capacity matters at the end of the day.

Perhaps more importantly, the explanation seems to describe how switching technology could work in an idealized scenario. I’m not sure how relevant it is to how switching occurs today in the real world. US Mobile appears cognizant of that. In comments on the announcement, Khattak suggests latency may play a role in switching decisions. If latency is accounted for, that may occur outside of the process described in the excerpt above.

Network Switching Is Complicated

My hunch is that US Mobile doesn’t fully understand how OS-level switching decisions are made. And I don’t mean that as a dig. I consider network switching one of the most interesting technologies emerging in cellular, and I don’t understand how it works. The underlying mechanisms could even be changing as Google and Apple update their operating systems.

Anyhow, it’s great to see a new multi-network option hitting the market—particularly one that comes without an outrageous price point.