Yesterday, the MVNO Ting released a video and a blog post announcing that the company will now offer service over a third network.

Hidden network partners

In the announcements, Ting acknowledges contractual obligations that prohibit the company from explicitly mentioning all of the networks the company offers service over:

Due to the restrictions, Ting makes roundabout statements like: “Ting Mobile offers service on every network but AT&T.”

Fortunately, I’m not bound by the same contractual arrangements that restrict Ting. Before yesterday’s announcement, Ting offered service over T-Mobile and Sprint’s networks. As of yesterday, the company now offers service over Verizon’s network as well.

Better coverage with Verizon

Michael Goldstein, Ting’s Chief Revenue Officer, was surprisingly candid in the announcement video. He acknowledged that Ting hasn’t always been able to offer stellar coverage (emphasis mine):

An improved value proposition

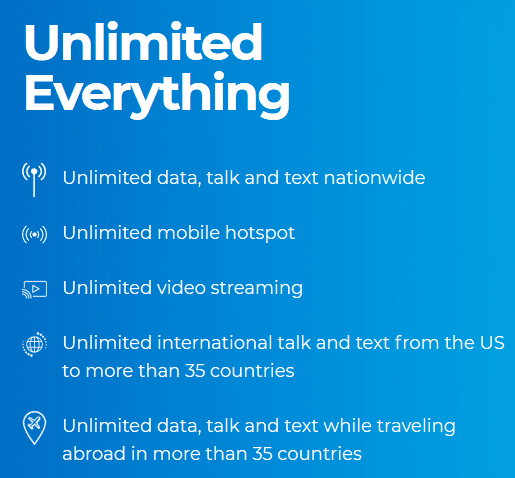

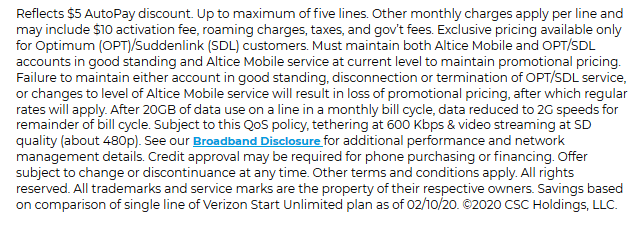

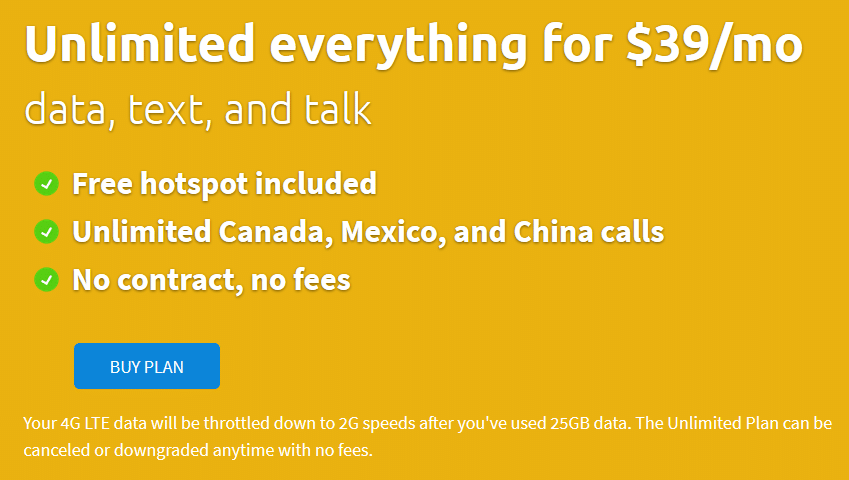

Despite the fact that Verizon’s network offers the best coverage in the nation, Ting didn’t change its pricing structure. Ting’s now has some of the best options on the market for families that don’t use a lot of data. That said, Ting’s options for heavy data users and single-line plans aren’t as enticing.

Discovering your Ting network

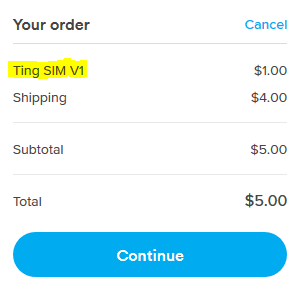

I’m really optimistic about Ting’s new service, and I’ve gone ahead and ordered a SIM card to trial it. I plan to update my review of the carrier as soon as I get a chance.

To keep things simple and stay in accordance with the contractual obligations discussed earlier, Ting doesn’t explicitly tell each subscriber the network he or she is being placed on. Instead, potential customers enter their addresses and their devices’ IMEI numbers, and Ting’s automated system places appropriate SIM cards in customers’ carts. In most cases, I expect new Ting customers will be placed on Verizon’s network, but there will be exceptions. Customers with certain kinds of devices and customers living in certain regions may still be matched with Sprint or T-Mobile’s networks.

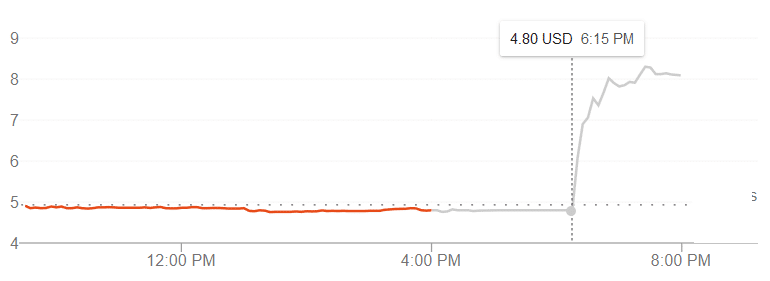

To verify that you’re being matched with Verizon’s network, take a look at the type of SIM card that ends up in your cart during the checkout process. Verizon SIM cards will be marked as V1: