Virgin Mobile USA, a flanker brand owned by Sprint, is shutting down. Today, reports surfaced from many Virgin Mobile customers who received texts that started like this:

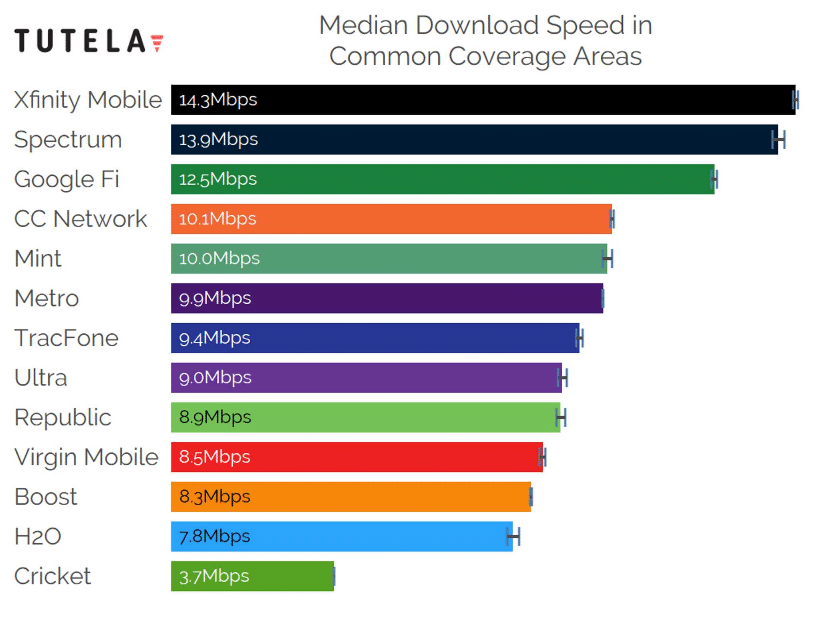

Boost Mobile is another flanker brand owned by Sprint, and it should offer almost all customers service that is quite similar to the service Virgin Mobile USA has been offering.

Interestingly, I can’t find a press release from Virgin Mobile about the shutdown. However, the company has published a web page with an FAQ about the upcoming changes. The page illuminates several details about how the automated transfer of subscribers from Virgin to Boost will be handled:

- Subscribers will keep their existing phone numbers.

- Subscribers should be able to keep their current phones.

- The transfers will begin in February.

- Boost Mobile will not accept Paypal. Subscribers that paid for Virgin service with PayPal will need to choose a new payment method.

- Payment dates will usually be unaffected by the transfer from Virgin to Boost.

- Subscribers automatically paying for Virgin service via credit card or debit card will have their payment methods transferred automatically.

- Device insurance purchased from Virgin should carry over to Boost.

- Devices using Virgin’s Mobile Broadband service will not automatically be transferred to Boost. Subscribers using these devices will need to find new carriers.1

Virgin Mobile USA suggests that most subscribers will receive pricing with Boost that is the same or better than existing pricing with Virgin:

While Virgin Mobile USA is suggesting customers will not face increased prices, I suggest that subscribers pay attention to any changes in their bills and plans over time. While I expect most subscribers will not be affected adversely in the short-term, it doesn’t look like Boost has committed not to raising prices or forcing plan changes in the future. I’d be especially vigilant if you currently have a grandfathered plan that Virgin no longer offers to new customers.

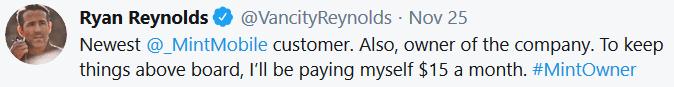

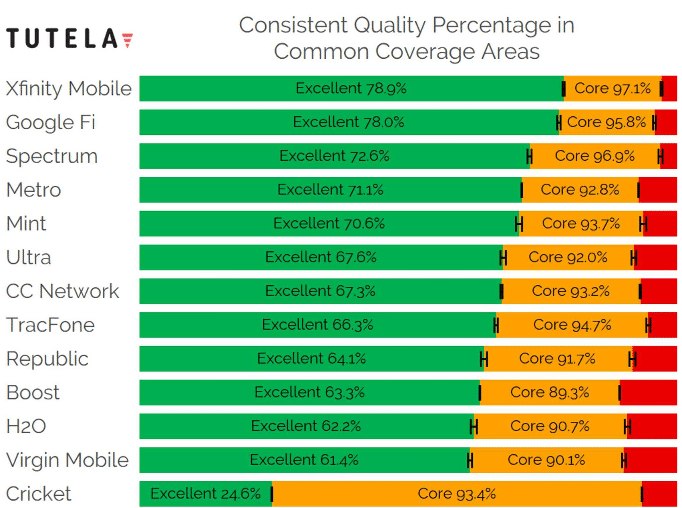

In most cases, I think Virgin subscribers should anticipate a smooth transition to Boost. Still, the transition may present a good moment for subscribers to consider other options on the market. Mint Mobile, a relatively new, low-cost carrier, may offer many people better coverage and lower prices than Virgin or Boost.

Why is Virgin Mobile USA shutting down?

On the FAQ page about Virgin’s shut down, one of the questions listed is: “I have been a Virgin Mobile customer for a long time, why is my account being transferred to Boost Mobile?” Virgin responds to the question with a non-answer:

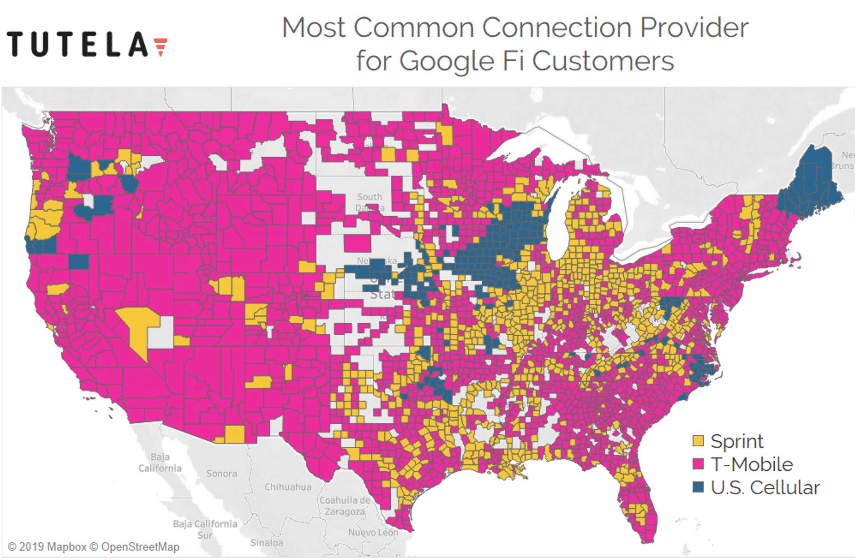

While I’m unsure exactly what’s going on, I expect there’s an effort underway to consolidate Sprint’s flanker brands in advance of news about whether a merger between Sprint and T-Mobile will go through.