Post redacted

Post redacted

Yesterday, the MVNO Ting released a video and a blog post announcing that the company will now offer service over a third network.

In the announcements, Ting acknowledges contractual obligations that prohibit the company from explicitly mentioning all of the networks the company offers service over:

Due to the restrictions, Ting makes roundabout statements like: “Ting Mobile offers service on every network but AT&T.”

Fortunately, I’m not bound by the same contractual arrangements that restrict Ting. Before yesterday’s announcement, Ting offered service over T-Mobile and Sprint’s networks. As of yesterday, the company now offers service over Verizon’s network as well.

Michael Goldstein, Ting’s Chief Revenue Officer, was surprisingly candid in the announcement video. He acknowledged that Ting hasn’t always been able to offer stellar coverage (emphasis mine):

Despite the fact that Verizon’s network offers the best coverage in the nation, Ting didn’t change its pricing structure. Ting’s now has some of the best options on the market for families that don’t use a lot of data. That said, Ting’s options for heavy data users and single-line plans aren’t as enticing.

I’m really optimistic about Ting’s new service, and I’ve gone ahead and ordered a SIM card to trial it. I plan to update my review of the carrier as soon as I get a chance.

To keep things simple and stay in accordance with the contractual obligations discussed earlier, Ting doesn’t explicitly tell each subscriber the network he or she is being placed on. Instead, potential customers enter their addresses and their devices’ IMEI numbers, and Ting’s automated system places appropriate SIM cards in customers’ carts. In most cases, I expect new Ting customers will be placed on Verizon’s network, but there will be exceptions. Customers with certain kinds of devices and customers living in certain regions may still be matched with Sprint or T-Mobile’s networks.

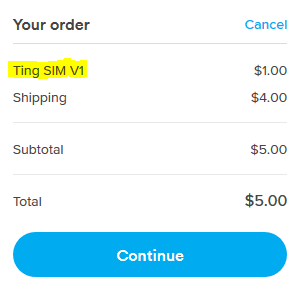

To verify that you’re being matched with Verizon’s network, take a look at the type of SIM card that ends up in your cart during the checkout process. Verizon SIM cards will be marked as V1:

Alice Mobile recently increased its prices by $10 per month. Service now costs $30 each month for Optimum or Suddenlink customers and $40 per month for everyone else.

In September, I argued that Altice Mobile was doing a lousy job of disclosing the limitations that came with the carrier’s supposedly “unlimited” plan. Given the recent price increase, I figured now would be a good time to revisit Altice Mobile’s policies.

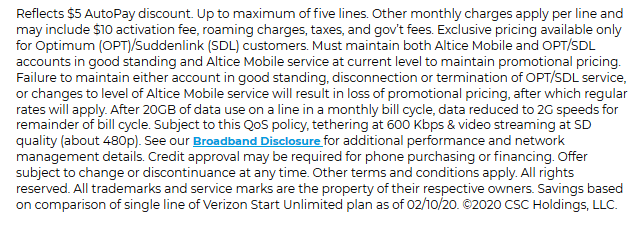

Altice is still imposing a lot of limits on its “unlimited” plan:1

Previously, video and hotspot traffic would be throttled more intensely after 50GB of use. It looks like Altice has decreased that threshold to 20GB.

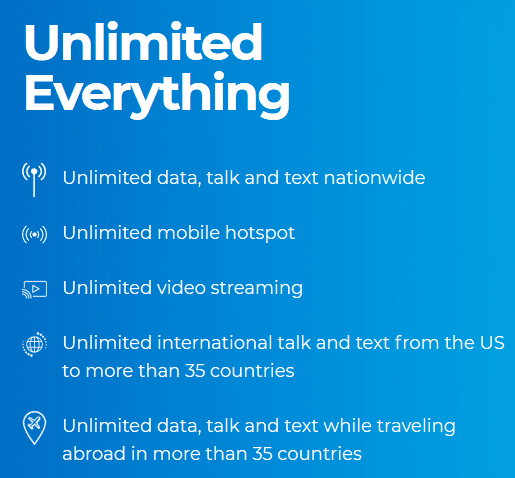

Altice continues to advertise “unlimited everything.” Here’s a screenshot from Altice’s website today:

As before, it’s misleading for Altice to suggest subscribers can stream an unlimited amount of video or use an unlimited amount of mobile hotspot data. After 20GB of use, subscribers will be throttled to a maximum speed of 128Kbps for video and hotspot traffic. At 128Kbps, continuous streaming of conventional video won’t be possible.2 Many activities subscribers will want to do over a hotspot connection will be frustratingly sluggish if not impossible.3

To Altice’s credit, it looks like the carrier is doing a bit better disclosing limitations. With a single click, website visitors can view additional information:

Altice’s Broadband Disclosure Information seems easier to find than it was previously. While the disclosures still fall short of being explicit or easy-to-understand, Altice is moving in the right direction.

Several state attorneys general have been suing to stop a merger between T-Mobile and Sprint. Rumors came out earlier this evening that the judge presiding over the case is planning to rule in favor of the merger. Here’s a bit from a Wall Street Journal article:

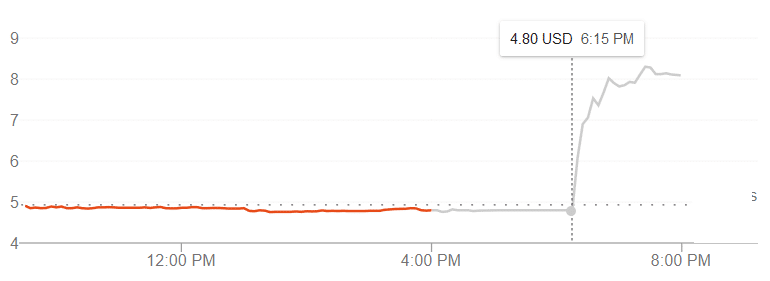

The rumors are almost certainly correct. Sprint’s stock soared in after-hours trading. The market closed with Sprint trading at close to $4.80. Since then, the stock has been trading for almost 70% more at over $8 per share:1

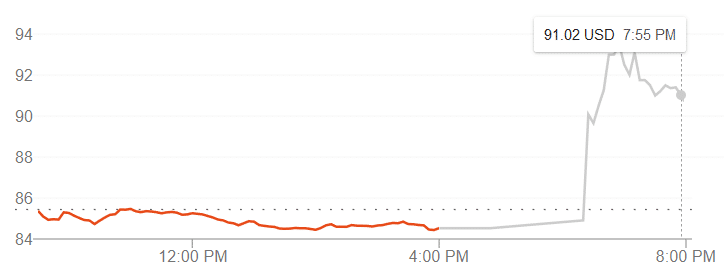

T-Mobile’s stock experienced a more modest after-hours rise from about $85 per share to slightly over $90 per share:

I’m planning to write something more detailed once the news is made official and the companies involved release statements.

Wireless networks have finite capacities. If enough users try to send data over a network at the same time, the network will become congested and deliver slower speeds.

Not all users will see the same decreases in speeds during congestion. Prioritization policies govern how different people on a network are affected by congestion. In many cases, subscribers with premium service plans will be prioritized ahead of subscribers on low-cost plans. When low-priority subscribers are experiencing sluggish speeds during congestion, they’re often described as being “deprioritized.”

There’s a shocking lack of public information about prioritization policies. Over the last year, I’ve dug into legalese to figure out how major carriers prioritize different plans, looked into the technical mechanisms behind prioritization, and spoken with industry experts. I’ve created what I believe is some of the most detailed content about prioritization policies among carriers in the U.S. Despite all that, I regularly find myself confused about prioritization.

Carriers typically disclose the possibility of deprioritization in fine-print statements along these lines:

Mobile virtual network operators (MVNOs) are often prohibited from discussing specific terms of their arrangements with host networks. In many cases, MVNOs can’t even make clear statements about which networks they operate over. In preparation for this post, I talked with a few people who are knowledgeable about the MVNO industry. None of them wanted to be quoted.

The general view among participants on online forums about the wireless industry is that almost all MVNO subscribers are deprioritized. However, there are competing claims. The MVNO Ting published a blog post titled Do MVNOs get second class cell service? The post explicitly states that Ting subscribers on Sprint’s network have priority on-par with typical Sprint subscribers. Ting’s post also seems to carry an implicit suggestion that subscribers using other MVNOs are usually not deprioritized:

Wirecutter has written about prioritization, and it looks like the company reached out to a handful of carriers about their policies (emphasis mine):1

I don’t buy it. Xfinity Mobile, a popular Verizon reseller, explicitly acknowledges deprioritization:

Verizon makes it clear that its own prepaid subscribers will be deprioritized during congestion. Verizon’s flanker brand, Visible, also deprioritizes subscribers’ data.2

While these facts don’t rule out the possibility that Verizon gives high-priority access to some resellers, I’d be awfully surprised if subscribers with Verizon resellers typically have higher priority than a large portion of Verizon’s own subscribers.

There are a lot of reasons people experience slow speeds, and people may be too quick to assume that deprioritization is the source of lousy speeds. Unfortunately, I don’t know of any publicly available data that sheds light on how often deprioritization causes trouble for consumers. As far as tell, drive tests assessing network performance typically use high-priority services. I’d be interested to see how assessments would come out tests were run with low-priority services.

I’m aiming to offer the best public-facing content about prioritization policies. If you work in the wireless industry and would like to talk publicly or privately about prioritization policies, please reach out.

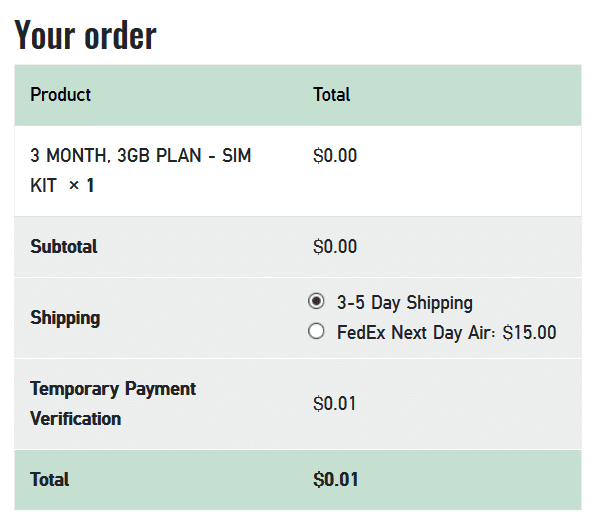

During the Super Bowl, Mint Mobile was offering new customers three months of free service. In my earlier post about the promotion, I said that I thought the deal wouldn’t have any serious catches or gotchas that made it less appealing. Sure enough, that’s how things panned out. I really appreciate that Mint Mobile doesn’t engage in gimmicks to nickel-and-dime its customers.

As expected, new customers were able to get free service, a free SIM card, and free shipping:

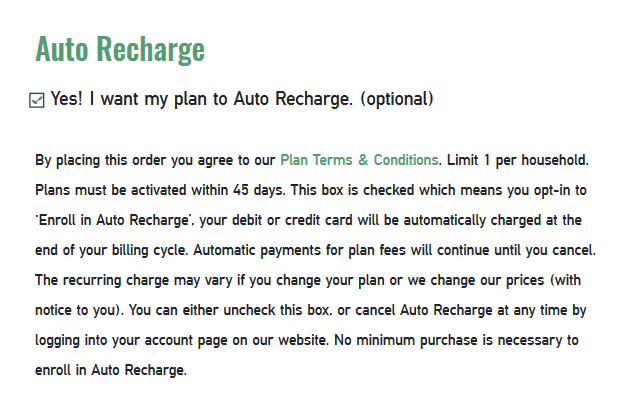

Before the promotion launched, I wondered whether Mint Mobile would try to push people into plans that renewed automatically. I’m happy with the approach Mint took. On the checkout page for the promotion, Mint conspicuously featured details about its auto recharge program. While the auto recharge box was checked by default, the program was clearly explained, and the box was easy to uncheck:

In my last post, I wrote:

Sure enough, Mint extended the promotion. Here’s a screenshot from Mint’s website last night:

When I checked Mint’s website shortly after midnight on the West Coast, the promotion looked like it was still running. When I checked Mint’s website this morning, the promotion was over.

RootMetrics recently tweeted about how its latest analyses prove which networks are the fastest and most reliable:

I’m a big fan of RootMetrics, but the tweet annoyed me. There’s a ton of flexibility in how network evaluators can approach their work. Will performance data be crowdsourced from consumers or collected via in-house testing? How will data be cleaned and aggregated? What regions will be included? Etc.

Phrases like “fastest network” and “most reliable network” are ambiguous. Do you determine the fastest network based on average download speeds, median download speeds, or something else?

RootMetrics’ tweet is especially odd in light of their latest report. Depending on which speed metric you choose to look at, you could argue that either Verizon or AT&T has the fastest network. AT&T narrowly beats Verizon in terms of median download speed. Verizon narrowly beats AT&T in RootMetrics’ overall speed scores.1

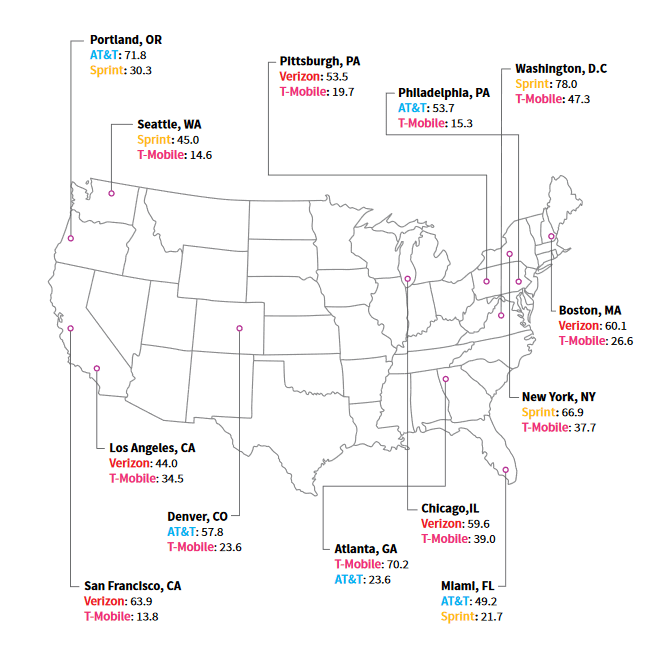

RootMetrics’ most recent report includes information about network speeds in city centers. Here’s how RootMetrics’ describes the tests:1

The results are presented with the following graphic that lists the median download speed in megabits per second from the fastest and slowest network in each city:2

Despite Sprint’s lousy performance in RootMetrics’ overall, national-level results, Sprint still managed to offer the fastest speeds in 3 of the 13 city centers RootMetrics considered. The results are consistent with a point I’ve tried to emphasize in the past: if you tend to stay in one area, you shouldn’t worry too much about national-level network performance.

I haven’t seen information about which plans RootMetrics’ test devices use on each network. In fact, I’m not entirely sure RootMetrics uses service plans that are available to regular consumers. My guess is that RootMetrics’ test devices have prioritization and quality of service levels at the high-end of what’s available to regular consumers. If my guess is correct, RootMetrics’ test devices have higher priority than many budget-friendly services that run over the Big Four networks. A few examples of those services:

Subscribers using low-priority services are especially likely to experience slow speeds in congested areas. I’d be interested in seeing RootMetrics rerun its city-center tests with low-priority services.