Mint Mobile launched an unlimited plan this morning. It’s available for as little as $30 per month.

Plan terms

Like many unlimited plans offered by mobile virtual network operators (MVNOs), the plan isn’t actually “unlimited” in the mainstream sense of the word:

- Subscribers can use 35GB of regular, full-speed data each month. After 35GB of data use, Mint throttles speeds to a sluggish 128Kbps.1

- Mint caps mobile hotspot use at 5GB per month.

I’ll save my complaints about Mint misusing the word “unlimited” for a second post. 35GB of data and 5GB of mobile hotspot access will be sufficient for the vast majority of people.2

Like Mint’s old plans, the new plan includes unlimited minutes and texts. Calling to Canada and Mexico is also included at no charge.

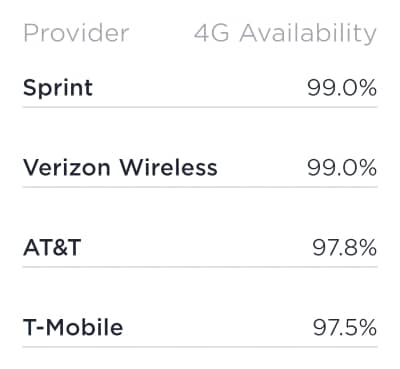

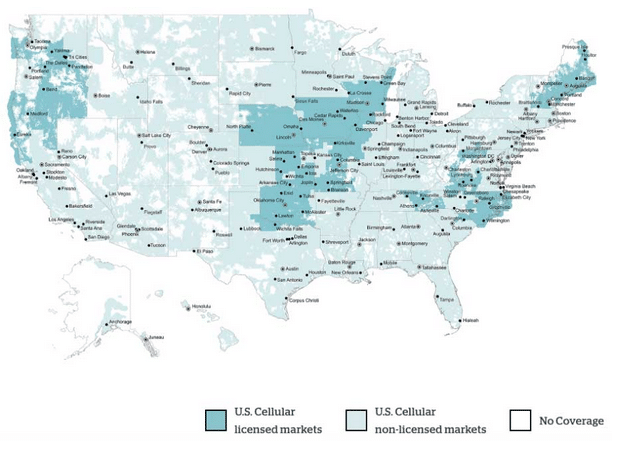

Subscribers with 5G-capable devices will get access to 5G coverage from T-Mobile’s network. While T-Mobile’s 5G network is lackluster in terms of speeds, it leads the nation in 5G availability.

Pricing

With the new unlimited plan, Mint is continuing to price service based on how many months of service customers pay for upfront.

- $30 per month – 12 months of service

- $35 per month – 6 months of service

- $40 per month – 3 months of service

The unlimited plan is eligible for the same introductory offer that Mint offers on its other plans. New customers can purchase three months of service at the rate Mint usually reserves for customers that purchase 12 months of service. I.e., three months of service on the unlimited plan costs $90 ($30 per month).

Reflections

Competitiveness

I’m glad to see Mint offering a plan for heavy data users with such a low price point. I expect the plan will be popular, especially among people who only need one or two lines of service. The new Mint plan should be competitive with other low-cost unlimited plans offered by carriers like Visible and Cricket. While I don’t think Mint’s new plan will make T-Mobile’s Essentials plan irrelevant, I’m ready to argue Mint’s plan is almost strictly the better option.

Pricing strategy

Interestingly, Mint has narrowed the distance between pricing tiers with the new plan. Mint’s 8GB plan costs $20 per month for customers that purchase a year of service upfront. The plan is 75% more expensive ($35 per month) for customers that purchase 3 months of service.3 Mint’s unlimited plan is only 33% more expensive for customers that opt for 3 months of service.4

In the past, I’ve wondered whether Mint’s pricing structure made volume discounts too aggressive. The large difference between monthly rates on three-month terms and twelve-month terms may have made the carrier unappealing to budget-sensitive consumers that could have been a good fit for Mint. Is it possible we’ll soon see Mint narrow the gap between pricing tiers on its old plans?

Mint’s new approach to pricing has a funny consequence. In some situations, Mint’s 12GB plan is now $5 per month more expensive than the 35GB (unlimited) plan.5