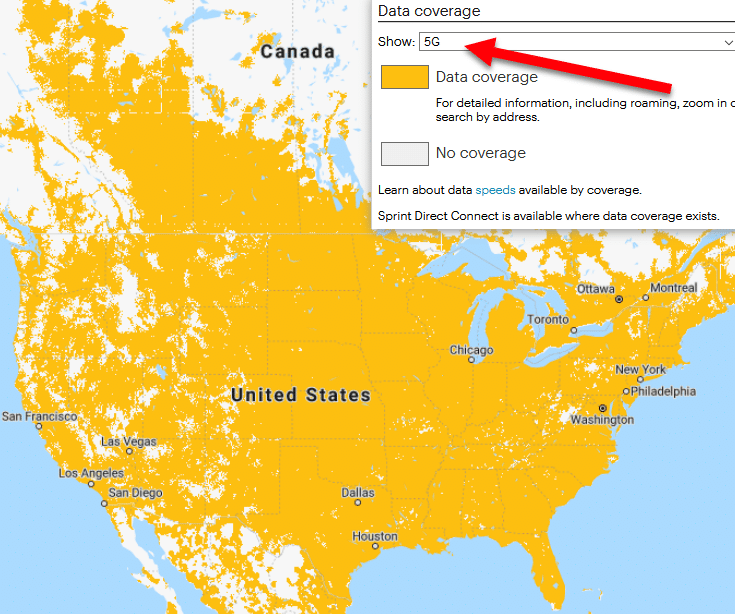

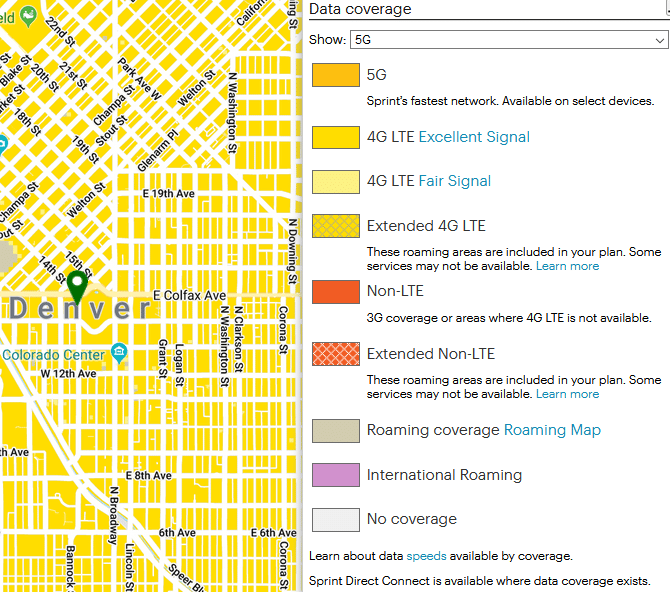

Mike Dano of Light Reading recently reported that T-Mobile plans to shut down Sprint’s LTE network by June 30, 2022.

Ever since T-Mobile’s acquisition of Sprint, I’ve been wondering when Sprint’s LTE network would go offline entirely. I’m not convinced the June 30 date will stay in place. These sorts of deadlines tend to get pushed back. Often repeatedly.

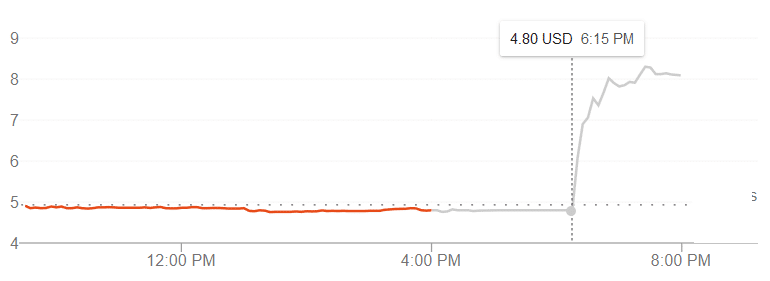

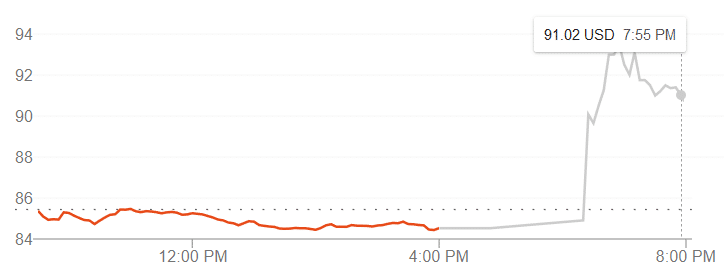

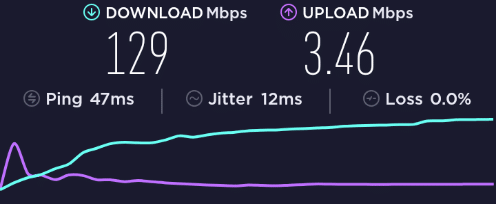

As we get closer to the final days of Sprint’s LTE network, I expect we’ll gradually see the network lose power as T-Mobile repurposes Sprint’s assets for T-Mobile’s own network.