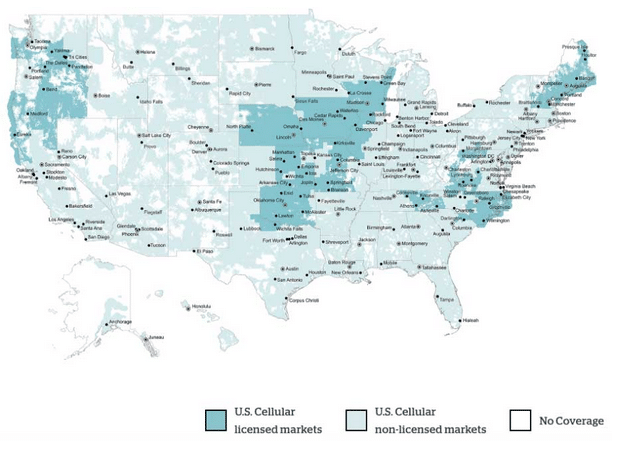

Today, the MVNO Twigby officially announced that it’ll switch from Sprint’s network to Verizon’s network.1 MVNOs like Twigby are usually prohibited from advertising the names of their host networks, so it’s unsurprising that “Verizon” doesn’t explicitly appear in Twigby’s announcement. However, there are plenty of indicators. Twigby’s announcement includes a red coverage map and describes the new network as the “nation’s largest and most reliable”.

Previously, Twigby allowed voice and text roaming on Verizon’s network for customers outside of the range of Sprint’s network. With the latest change, Twigby will drop Sprint entirely and move to offering voice, text, and data over Verizon’s network. New customers will access Verizon’s network automatically. Existing Twigby customers can continue to use Sprint’s network until at least the end of the year. Customers that want to switch to Verizon sooner can opt to do so.

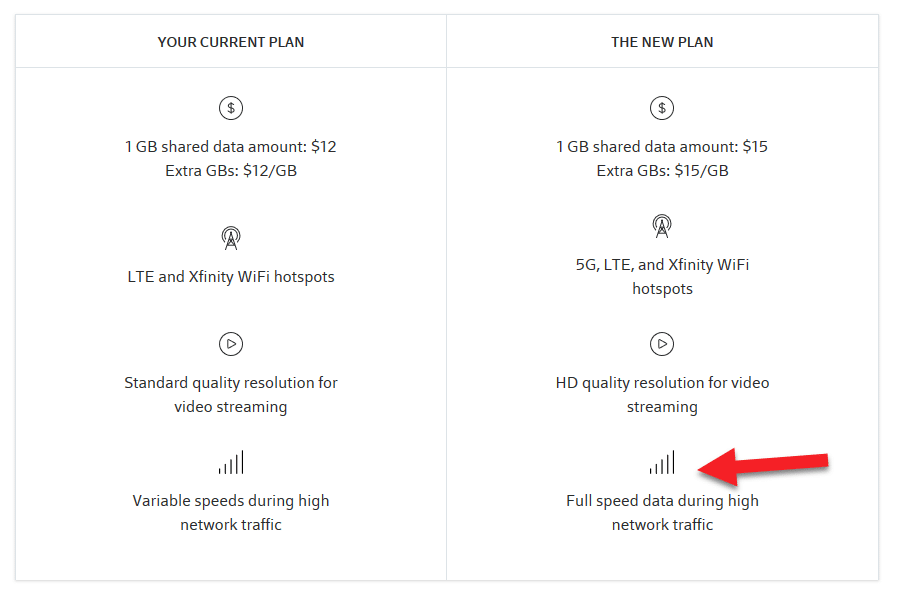

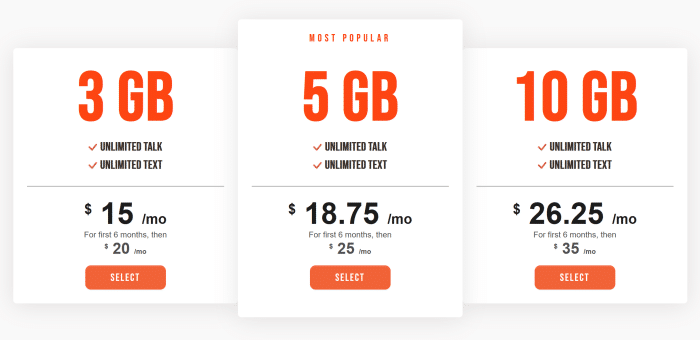

Overall, I think this change is great for Twigby. Verizon offers far better coverage than Sprint, and Twigby appears to be keeping its prices unchanged for the moment. Some of Twigby’s plans rates are well-priced for Verizon’s network:

US Mobile, another small MVNO offering service over Verizon’s network, still has better prices, but Twigby is offering real competition.

Supposedly, Twigby’s Verizon service includes 5G access for subscribers with compatible phones. I wonder whether iPhone 12 users will actually get 5G service. The MVNO Tello recently advertised 5G service while neglecting to mention that 5G iPhones were not supported.