TracFone, the company behind several large MVNOs, appears to be working on a new product called SmartSIM. Apparently, some TracFone customers recently received a marketing email that mentioned SmartSIM.1 I was briefly able to access NoDeadZone.com, a website that shared some basic information about SmartSIM. Oddly, the website now automatically redirects to locations.totalwireless.com (Total Wireless is a brand owned by TracFone).

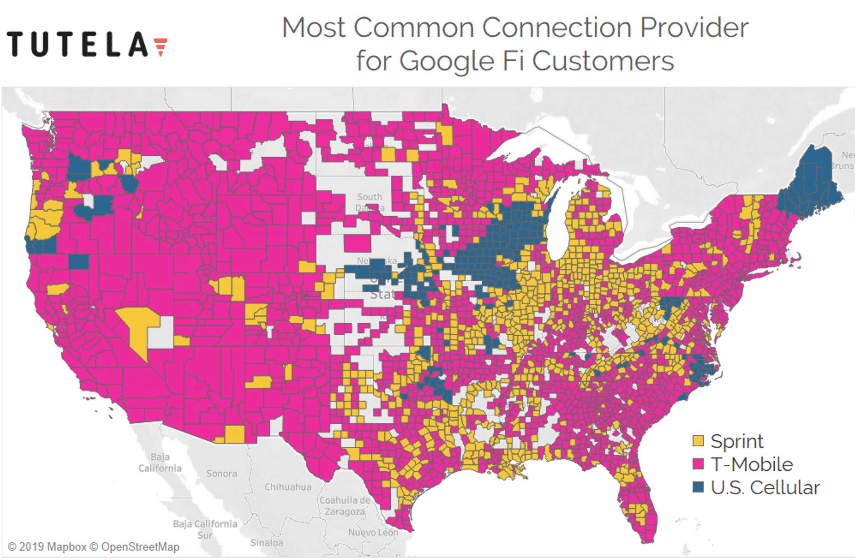

While NoDeadZone.com was accessible, it offered a short video explaining SmartSIM. Apparently, the technology will allow subscribers to switch rapidly between multiple networks based on which network offers the best signal. There’s been some speculation about how up-and-coming eSim technology may enable more people to take advantage of dynamic network switching of this sort. However, the video I gave me the impression that SmartSIM would involve a conventional, removable SIM card rather than an eSIM. At the moment, I’m unsure if TracFone is licensing switching technology Google Fi built, introducing new technology, or something else.

NoDeadZones.com allowed visitors to enter their zip codes to see if SmartSIM was available where they lived. I tried several zip codes, and all were ineligible. It seems that other people had the same experience. I’m not sure whether any zip codes were really eligible for the service.

So far, I haven’t heard of TracFone responding to any requests for more information about SmartSIM. I’m curious about the lack of communication along with the decision to redirect NoDeadZone.com to the main Total Wireless site. It’s enough to make me wonder whether a mistake was made that led SmartSIM to become public knowledge before TracFone intended.

I’ll be keeping close tabs on how the story develops. Dynamic network switching has the potential to improve wireless service and change how it’s priced. With switching technology, it may be possible to charge different rates to different subscribers based on factors like a subscriber’s location, the extent of network congestion, or the quality of service a subscriber receives. Dynamic pricing could potentially lead to far more efficient network usage than conventional pricing—which might ultimately lead to a decrease in how much consumers pay for wireless service.