Today, Verizon announced a huge expansion of its 5G service.

More millimeter wave

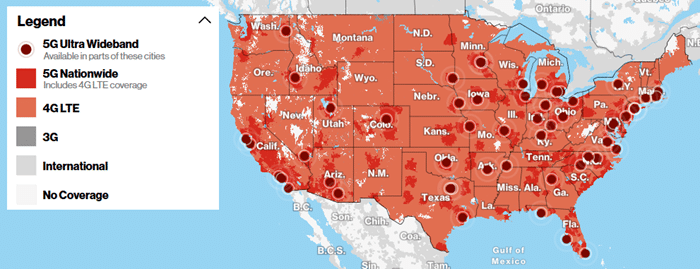

According to today’s press release, Verizon added ultra-fast, millimeter wave 5G service to parts of 19 cities, 19 stadiums, and 6 airports. In total, millimeter wave service from Verizon is now available in parts of 55 cities and 43 stadiums.

Nationwide, low-band 5G

Verizon also announced that it’s now using dynamic spectrum sharing (DSS) to offer slower, low-band 5G to over 200 million customers.1

According to Verizon’s coverage map, the low-band 5G service is available in most densely populated areas, but only a minority of the U.S. by land area. Here’s a screenshot from the map today:

I’m writing this post from an area allegedly in Verizon’s 5G coverage profile. My Galaxy S20 5G phone is still showing a 4G connection.

Carrier aggregation

Today’s press release also includes a boast about Verizon’s recent achievements with bleeding-edge carrier aggregation technology: