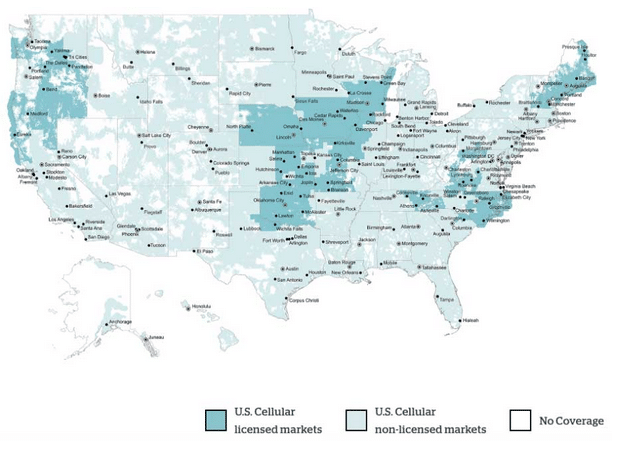

News came out today that most of Ting’s assets, including Ting’s mobile customers, have been acquired by DISH:1

Tucows, Ting’s original parent company, will retain ownership of Ting’s technology stack. Tucows plans to offer Mobile Service Enabler (MSE) solutions to help wireless carriers run their businesses. Here’s a bit of information I received from Tucows’ PR team:

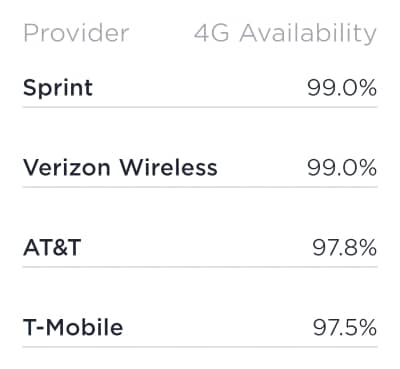

The Verizon Network

So far, I haven’t seen Ting directly address the plans for the carrier’s Verizon-based service. An email from Ting’s PR team said there would be “no data migration, service interruption or billing changes.”

I expect customers on Ting’s Verizon-based service will not be forced to migrate immediately. I’m not sure what will happen in the long term.