I recently stumbled across a fantastic post by Doug Dawson about the government’s role in 5G. Here’s a bit of it (emphasis mine):

I mostly agree with Dawson, and I strongly recommend the full post.

I recently stumbled across a fantastic post by Doug Dawson about the government’s role in 5G. Here’s a bit of it (emphasis mine):

I mostly agree with Dawson, and I strongly recommend the full post.

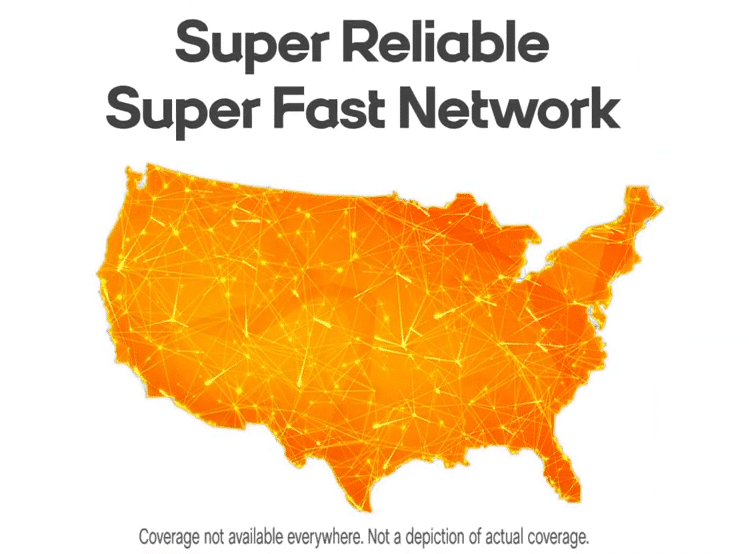

Boost Mobile is running a new commercial that features Pitbull and pitches the company’s low prices. Towards the end of the ad, a narrator says that Boost has a “super fast, super reliable network.” The narration is accompanied by this image:

In most commercials that involve carriers making claims about service quality, carriers will use fine print to cite research that backs up their claims. The Boost ad doesn’t include a citation; perhaps that’s because Boost’s claim doesn’t have much substance. “Super fast, super reliable” is super vague. Boost’s service probably is super fast compared to wireless service from 15 years ago. On the other hand, Boost’s service is not super fast compared to most services currently offered by other U.S. carriers.

Boost runs over Sprint’s network. There are a lot of different companies that evaluate network performance, and Sprint tends to do poorly relative to its competitors in the rigorous evaluations. Sprint had the lowest speeds among all four major networks in both RootMetrics’ and Opensignal’s most recent national assessments.

Boost’s claim looks even sillier in light of the fact that its subscribers tend to have low priority data access on Sprint’s network. When Sprint’s network is congested, Boost Mobile’s subscribers will tend to experience slower data speeds than those who subscribe directly to Sprint’s service.

A misleading image accompanies Boost’s misleading claims about quality. The image looks like a coverage map showing extensive coverage, but a disclaimer states: Coverage not available everywhere. Not a depiction of actual coverage.

Here’s the full commercial:

The mobile virtual network operator BOOM! Mobile recently launched wireless plans that run over T-Mobile’s network. With this addition, BOOM! now offers three types of plans:

Many of the Boom! Pink plans have the same allotments of minutes, texts, and data as well as the same price points as previously existing Boom! Red plans. Boom! Blue plans with allotments equivalent to those in Pink and Red plans are sometimes available, but they tend to have higher price points.

BOOM! Mobile is also offering several Boom! Pink plans that are unlike the company’s previous offerings. These plans each offer a certain number of Flex Points. Each point can be redeemed for either 1 minute of calling, 1 text message, or 1MB of data.

It’s great to see BOOM! Mobile expanding its offerings. For most consumers, I think the Red plans will continue to be the best option since (a) they aren’t more expensive than the Pink plans and (b) they run over Verizon’s extensive network. I expect most consumers looking for coverage over T-Mobile’s could find better deals with an alternative MVNO (e.g., Mint Mobile). Still, I’m glad to see BOOM! Mobile offering access to more networks. The new flex plans are particularly interesting. I’d love to see more carriers come out with plans that use similar structures.

The New York Times is running a series of articles on cell phone location tracking. The Times received access to a database with location data from about 12 million devices. In the series, reporters explain how easy it is to de-anonymize the allegedly anonymous location data. Here’s an excerpt from the first article:

I have quibbles with the articles, but I strongly recommend them. It looks like the Times is currently four articles into what will be a seven-article series.

The carrier US Mobile recently released new unlimited plans. As with US Mobile’s old plans, customers can choose either the Super LTE network or the GSM LTE network. Super LTE runs over Verizon’s network while GSM LTE runs over T-Mobile’s network. Plans appear to be priced the same regardless of the network a subscriber chooses.1

“Unlimited” is a bit of a misnomer for US Mobile’s new plans. The plans have limits, but the limits are dependent on which options subscribers select. Customers can choose either US Mobile’s “Fast” plan or its “Ludicrous” plan.

As I understand them, here are the limits on the Fast plan (base price of $40 per month):

The Ludicrous plan has a base price of $50 per month. The Ludicrous plan does not have a 5Mbps throttle, and mobile hotspot is included. As with the Fast plan, data use beyond 50GB (15GB with GSM) is throttled intensely.

I use the phrase “throttled intensely” because US Mobile doesn’t disclose its policies clearly. On its website, the company writes:

A US Mobile agent I reached out to confirmed that there is a throttle after the threshold level of data use is reached. The agent seemed reluctant to mention a specific speed cap but explained that speeds would feel like 2G. Following the argument I made in Unlimited Plans At 2G Speeds Are Bogus, I think it would be more transparent if US Mobile called their plan a 50GB plan. Extra data at slow speeds could just be a little perk. That said, I understand the carrier caving to the pressure to call its plans “unlimited”.

I don’t love the phrasing of “A tiny fraction of heavier data users may notice reduced speeds.” It seems to suggest that only some of the people who pass the threshold will have reduced speeds. As I understand it, US Mobile is imposing a serious speed cap on everyone who passes the threshold of 50GB. I’d suggest an alternate phrasing along the lines of Heavy data users, who make up a tiny fraction of our subscriber base, will experience substantially reduced speeds after 50GB of use..”

US Mobile’s Super LTE unlimited plans look competitively priced for those who only need one or two lines and want service over Verizon’s network. Large families can probably get better per-line rates by purchasing service from Verizon directly (Verizon drops its per-line rates on unlimited plans as more lines are added).

Unlimited plans purchased from Verizon’s Flanker brand, Visible, may be cheaper than US Mobile’s plans, but regular issues and limited device options with Visible may make US Mobile a better bet.

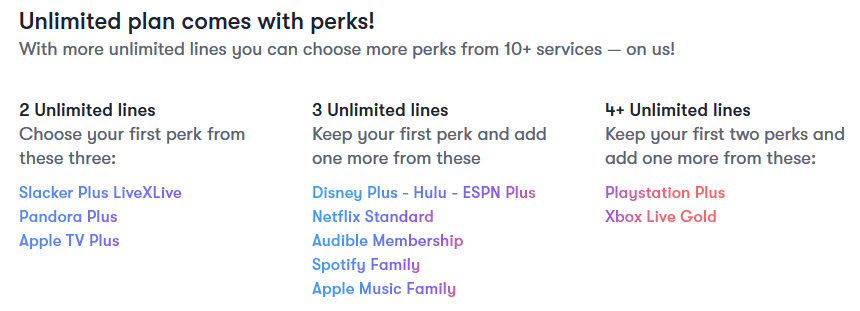

US Mobile also includes some other companies’ services as perks with their unlimited plans. Here’s a screenshot from the carrier’s website:

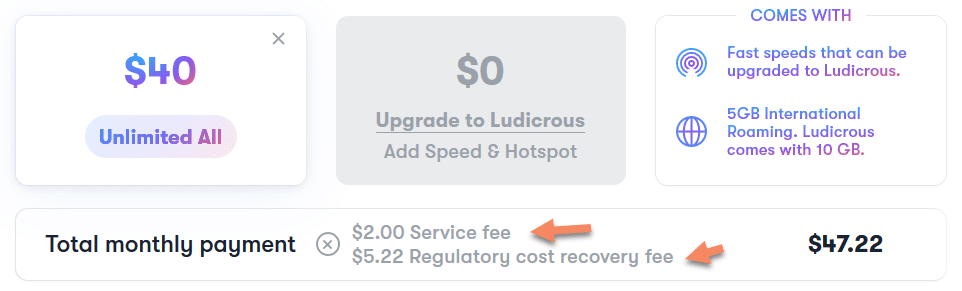

On the new unlimited plans, it seems US Mobile is still hiding fees. Most consumers won’t see these fees until after they’ve ordered a SIM card:

Both fees are annoying. One could argue the regulatory recovery fee is at least a fee that many other carriers are also hiding. The $2 per month service fee is unusual.

Deutsche Telekom (DT), the parent company of T-Mobile, has been making legal threats against companies that use the color magenta in their branding. DT has gone after companies outside of the telecom industry. DT has even tried to force companies to stop using shades of magenta that are different from the shade it uses. TechCrunch has a good article covering the ridiculous story in more detail.

In a funny turn of events, Itamar Kestenbaum, a software engineer at one of the companies DT has threatened, released a Google Chrome extension called Pink-out. Here’s how the app is described (emphasis mine):

I previously raved about Visible’s swap program. New customers used to be able to trade in almost any Android phone to get a free ZTE R2. In my case, I was able to trade in an old phone that was several years old for a much better device.

Visible recently made the swap program much better. The ZTE R2 has been dropped from the program, and customers now get to choose between the ZTE Blade A7 Prime and the Motorola Moto e6. I haven’t got my hands on either device yet, but from what I’ve read, both look like solid entry-level phones.

If you have an Android phone that powers on and isn’t already compatible with Visible, it should be eligible for the swap program. You can verify whether a device is compatible by entering its IMEI on Visible’s website. If you get a message that your device is incompatible, hit the “Next” button to continue with the swap program.

Last week, I released a new plan finder tool. Users accessing the tool can answer a few questions about how they use their phones, how budget-sensitive they are, and where they live. They’ll then be matched with a few carriers and plans that are likely to be well-suited for their needs.

A few other companies have released their own plan finder tools. These tools generally function by assuming the wireless industry is simpler and more commoditized than it is. For example, WhistleOut’s tool appears to assume that cell phone plans have only five features:

The allotments are all assumed to take fixed, numerical values. Plans’ prices are also assumed to take simple, fixed values. The host network is simply one of five options (Verizon, AT&T, T-Mobile, Sprint, or U.S. Cellular). Making these assumptions allows many carriers’ plans to be compared, sorted, and filtered with basic math and logic. Unfortunately, the assumptions sweep a lot of important nuances under the rug. For example:

While WhistleOut’s plan finder has a feature for checking coverage, WhistleOut appears to treat coverage as a binary thing—either you have coverage or you don’t. In reality, coverage quality is much richer. You can have mediocre coverage or strong coverage. You can have good coverage at your house but problematic coverage where you work.

While building CoverageCritic’s plan finder, I tried to account for things like prices, resource allotments, and coverage quality but kept in mind that these aspects of wireless service are complicated and often difficult to fully capture in simple models. While I can’t claim my tool is exclusively driven by hard data, I think my approach makes the tool more useful than competitor’s tools.

CoverageCritic’s tool makes predictions about coverage quality after drawing on geographic information provided by users. At the moment, state-level estimates of coverage quality are combined with user-provided information about population density. Population density proxies for coverage quality and is used to adjust state-level coverage estimates to arrive at location-specific predictions of coverage quality. In the future, I hope to refine the predictions of coverage quality by drawing on much larger data sets from carriers and network evaluators.

At the moment, the tool considers services from about ten carriers, and I plan to add more soon. The tool isn’t perfect, but it should be able to provide most consumers with a good starting point as they search for wireless providers.

Actor Ryan Reynolds recently announced that he has acquired an ownership stake in Mint Mobile. I expect that Reynolds only owns a part of Mint Mobile rather than the entire company, but I’m not entirely sure. In many places, Reynolds is described as the owner of Mint Mobile in a way that doesn’t seem incompatible with him having complete or near-complete ownership of the company.

From Reynolds’ Twitter bio:

From Reynolds’ tweet announcing involvement with Mint:

From a banner on Mint’s website:

However, Mint Mobile’s press release makes it sound like Reynolds only acquired partial ownership:

The press release suggests that Reynolds will become involved with Mint’s marketing and communications efforts. I’d love to see Mint come up with ads similar to this one that Reynolds used to promote his gin brand:

On Wednesday, the FCC released a fascinating report related to the Mobility Fund Phase II (MF-II). The MF-II is a planned program to provide federal funding for network build-outs in rural areas that are underserved by 4G coverage.

To determine which geographic areas were underserved, the FCC requested coverage maps and data from network operators. After reviewing the data and allowing outside entities to challenge the datas’ reliability, the FCC became concerned about the accuracy of the information shared by T-Mobile, U.S. Cellular, and Verizon. The FCC decided to conduct its own performance tests and compare the results of its tests to the information the network operators provided. Here’s what the agency found:1

When considering the accuracy of coverage maps, I try to think about the incentives network operators face. When advertising to consumers, network operators often have an incentive to overstate the extent of their coverage. However, incentives can run in the opposite direction in other situations. For example, when trying to get approval for a merger between Sprint and T-Mobile, Sprint had incentives to make its 4G coverage profile look limited and inferior to the coverage profiles of other nationwide networks.2

I’m not well-informed about the MF-II, so I don’t feel like I have a good grasp of all the incentives at play. That said, it’s not clear that all network operators would have an incentive to overstate their coverage. A network operator that claimed to offer coverage in an area it didn’t cover may limit competitors’ access to subsidies in that area. However, a network operator erroneously claiming to cover an area may prevent itself from receiving subsidies in that area.

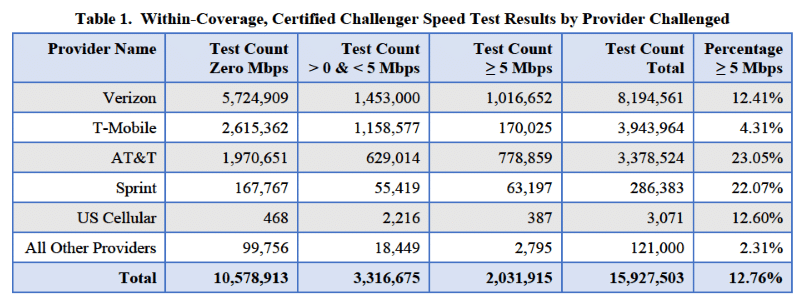

After network operators submitted coverage information to the FCC, a number of entities, including both governments and network operators, were allowed to challenge the validity of coverage information submitted by others. Here’s a bit more detail about the challenge process:3

About a fifth of the participating entities went on to submit challenges:4

The challenge data often showed failed tests and lackluster speeds in areas where network operators claimed to offer coverage:5

During the challenge process, some parties entered specific concerns into the record. For example:6

After reviewing the challenges, the FCC requested additional information from the five largest network operators (AT&T, T-Mobile, Verizon, Sprint, and U.S. Cellular) to understand the assumptions involved in the networks’ coverage models.

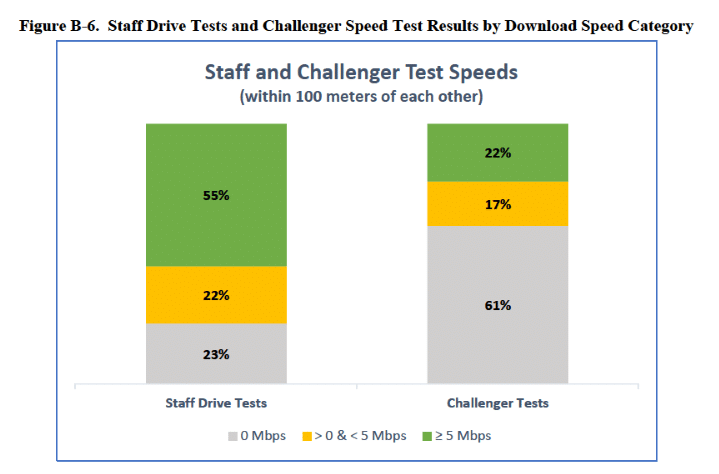

Around the same time the FCC was requesting additional information from network operators, the agency also began its own testing of Verizon, U.S. Cellular, and T-Mobile’s networks. These speed tests took place in 12 states and primarily made use of a drive-testing methodology. As mentioned earlier, analyses of the FCC’s test data suggested that the on-the-ground experience with Verizon, T-Mobile, and U.S. Cellular’s network was much different than the experience that would be expected based on the information the networks provided to the FCC.

A lot of the commentary and news articles I’ve seen in response to the FCC’s report seem to conclude that network operators are bullshitters that intentionally lied about the extent of their coverage. I have reservations about fully accepting that conclusion. Accurately modeling coverage is difficult. Lots of factors affect the on-the-ground experience of wireless subscribers. The FCC largely acknowledges this reality in its report:

Further supporting the idea that assessing coverage is difficult, the FCC didn’t just find that its tests contradicted the initial information submitted by network operators. The FCC data also contradicted the data submitted by those who challenged network operators’ data:

While the FCC found some of the information submitted by networks to be misleading about on-the-ground service quality, I don’t believe it ended up penalizing any network operators or accusing them of anything too serious.10 Still, the FCC did suggest that some of the network operators could have done better:

The FCC concluded that it should make some changes to its processes:12

The FCC’s report illustrates how hard it is to assess network performance. Assumptions must be made in coverage models, and the assumptions analysts choose to make can have substantial effects on the outputs of their models. Similarly, on-the-ground performance tests don’t always give simple-to-interpret results. Two entities can run tests in the same area and find different results. Factors like the time of day a test was conducted or the type of device that was used in a test can have big consequences.

If we want consumers to have better information about the quality of service networks can offer, we need entities involved in modeling and testing coverage to be transparent about their methodologies.