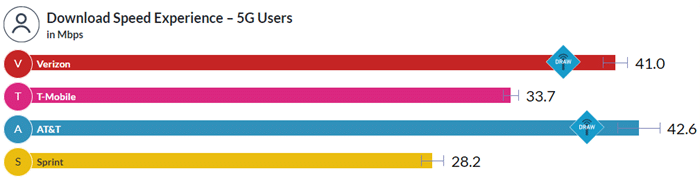

Verizon and AT&T both offer discounts on most prepaid plans when subscribers enroll in automatic payments.1 The carriers have different policies for when discounts kick in.

With AT&T, customers can enroll in automatic payments when they first place an order, and the discount for automatic payments kicks in immediately. I like AT&T’s approach. It’s simple.

With Verizon, the discount only kicks in after the first month of service. There’s a sense in which this is logical. Subscribers placing an order must manually pay for the first month of service. The first payment can’t be automated. On the flip side, it’s confusing. When discussing Verizon’s plans, it wouldn’t be accurate for me to say something simple like:

I’m not sure why Verizon doesn’t just offer a discount in the first month. Does the carrier benefit from making things complicated? Do fewer people enroll in automatic payments when the first month of service isn’t discounted?