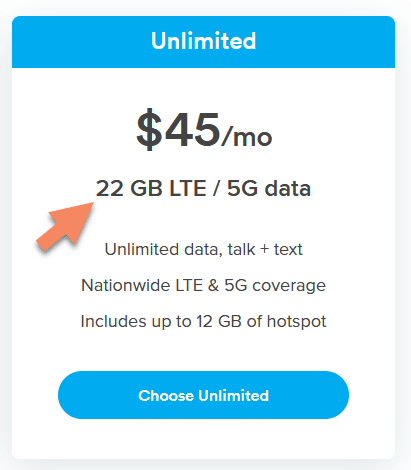

While convincing regulators to approve a merger between Sprint and T-Mobile, T-Mobile committed to allowing Dish to offload traffic to T-Mobile’s network for several years. Then, roughly a year ago, Dish announced that it formed a similar agreement allowing the company to piggyback on AT&T’s network.

On Tuesday, Dish announced that it renegotiated the arrangement with T-Mobile. Among other things, the amended agreement involves better pricing for Dish:

The new agreement will need to be approved by regulators. It’s expected to get a green light by the end of the summer.

Mike Dano at Light Reading wrote a more detailed article covering Dish’s announcement. While I don’t entirely trust the numbers, I found this excerpt especially interesting: