I’ve never used the Hello Mobile myself, but I’ve heard plenty of negative things about the carrier. Given how small Hello Mobile’s subscriber base is, the volume of negative reports is shocking. I like how a user in Reddit’s NoContract community, ruben3232, put it:

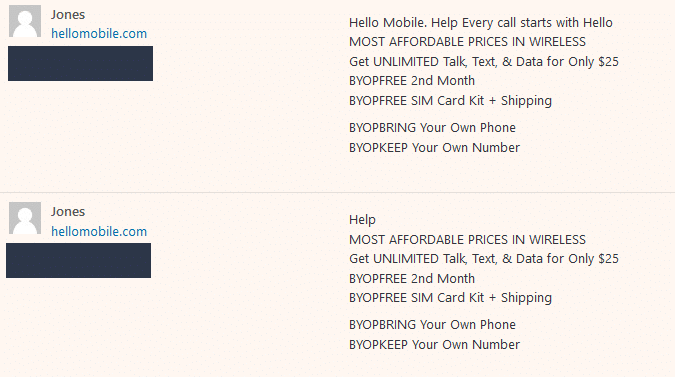

Today, I figured I’d post my own negative report. Hello Mobile seems to be using spam comments to promote the brand. Here’s a screenshot of two pending comments left on Coverage Critic:

I can’t be sure a Hello Mobile staff member (or a promoter hired by Hello Mobile) placed the comments, but I strongly suspect as much. While a competitor could be spamming to tarnish Hello Mobile’s reputation, I don’t find that plausible. Hello Mobile is a very small fish in the cellular market. Competing carriers have better ways to spend their time.