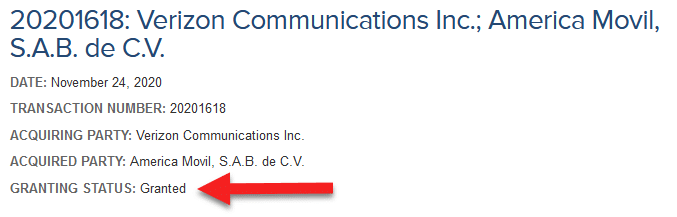

Update: The acquisition is officially complete.

In September of 2020, Verizon announced plans to acquire TracFone and its roughly 20 million subscribers. A while back, the deal was cleared by the FTC and the DOJ declined to hold back the process. The acquisition got its final green lights from the California Public Utilities Commission last Thursday and the FCC yesterday.

I expect the deal to close shortly with Verizon meeting its original goal of closing the deal in the second half of 2021. As expected, the FCC’s approval is conditional on Verizon adhering to some terms. The terms center around consumer protections. Most of the protections relate to the government’s Lifeline program which offers subsidies on phone service for low-income consumers.

Terms of Consumer Protections

Here’s my understanding of the most important and/or interesting terms based on a reading of the FCC’s press release and a skim of the 70-page Memorandum Opinion and Order:

- For at least seven years, Verizon must continue to offer TracFone’s Lifeline services in the areas they’re currently offered.

- For at least three years, Verizon must continue to offer existing Lifeline plans that provide service at no cost to consumers.

- Verizon must maintain some of TracFone’s existing roaming agreements to serve customers in some regions where Verizon does not offer coverage (I think this requirement lasts 3 years).

- Verizon must offer free devices and/or SIM cards to Lifeline subscribers that are required to transition to Verizon’s network.

- Verizon must extend its usual (60 day) unlocking policy to acquired customers.

- For three years, Verizon must extend agreements with MVNOs using its network without altering the terms of the agreements.

As a whole, the terms are less burdensome on Verizon than I’d expected. I previously wondered if Verizon would be required to sell competitors the almost ten million TracFone subscribers who are not currently on Verizon’s network. It looks like no one will force Verizon to do so, and I expect Verizon will transition most of these users to its network.

What Does This Mean For MVNOs?

With Verizon acquiring all of TracFone’s brands and customers, the size of the MVNO market in the U.S. will contract significantly. Further, Verizon may see reduced economic incentives to allow MVNOs to use its network. The FCC acknowledged this concern:1

Commenters argue that, because post-transaction, all significant MVNOs would be vertically integrated with the nationwide facilities-based providers, the vertically integrated MVNOs could coordinate to exclude or otherwise harm competing, standalone MVNOs or adopt parallel strategies to discourage postpaid customers from migrating to lower-cost prepaid plans. Second, commenters claim that coordination would be more likely because the transaction would remove an independently-competing maverick MVNO from the market.

However, it seems the FCC doesn’t take the concern too seriously:

Here’s what Verizon is ultimately committed to:

Reflections

My gut feeling is still that a world where this acquisition goes through will be a world with less competition and higher prices than we’d see in a world without the acquisition. However, I feel less strongly about that than I did a year ago.