T-Mobile’s former CEO, John Legere, was extremely successful in branding himself as an advocate for consumers. While I admire Legere’s success, I don’t think he lived up to the persona he created.1

Today, Legere shared a tweet that reaffirmed my feelings:

It’s been an honor to work with you @AjitPaiFCC. Best of luck on your next endeavor and thank you for being an advocate for wireless competition! https://t.co/5KqTt2tPiE

— John Legere (@JohnLegere) November 30, 2020

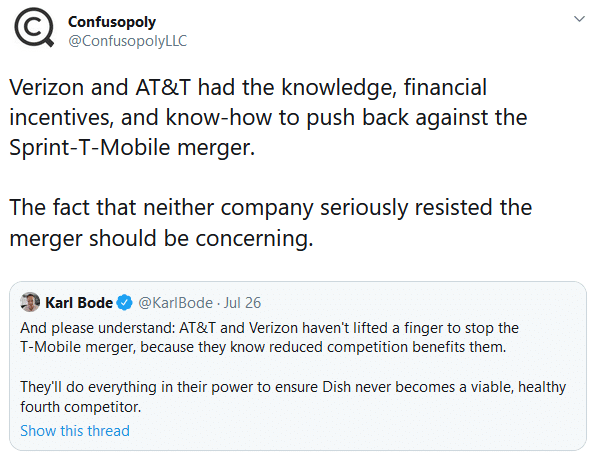

While I think a lot of criticism of Ajit Pai has been unfair, “advocating for wireless competition” is quite the phrase. It feels particularly insincere coming from Legere who made the better part of $100 million from a bonus and other compensation tied to the closure of the merger between T-Mobile and Sprint. I’m on the record saying I expected the merger to be bad for consumers. Eight months later, I continue to stand by my view.