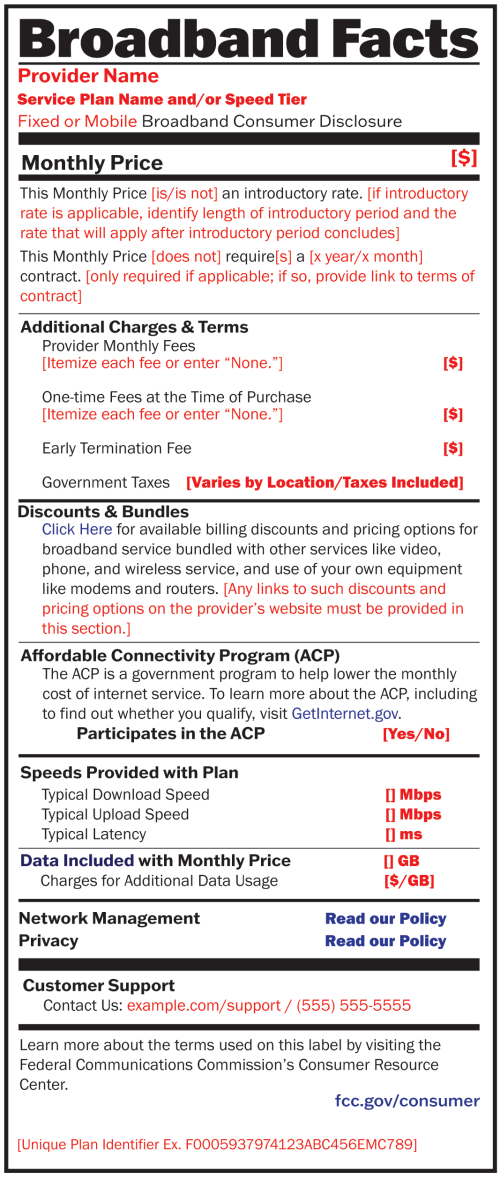

Starting April 10, internet service providers and cell carriers will be required to display Broadband Facts labels modeled after the FDA’s Nutrition Facts labels.1 Here’s a sample label from the FCC’s website:

Capturing Performance

The labels are great. They surface important information in a manner that’s easy for normal consumers to understand. Pricing-related details are displayed effectively, but the information about the performance of cell service leaves a lot to be desired. I can’t get past the feeling that the FCC created a label structure that made sense for internet service providers and shoehorned cell service into the same format.

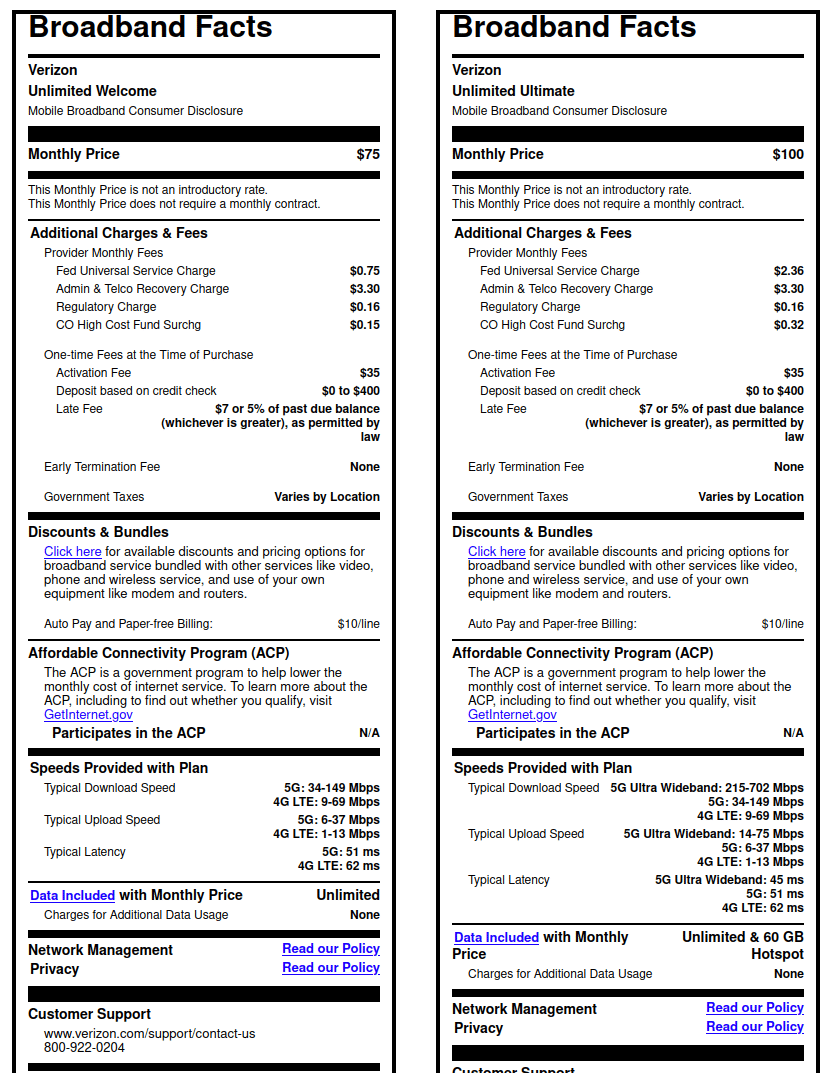

While the April 10 deadline hasn’t hit yet, Verizon has already published its labels online. The screenshot below shows labels for two plans, Unlimited Welcome and Unlimited Ultimate.

(Verizon’s website lets me enter an address in Colorado to get location-specific details on taxes and fees.)

What Are Typical Speeds?

Cellular speeds vary massively based on stuff like location, weather, congestion levels, and the device being used. Unsurprisingly, Verizon gives huge ranges for typical speeds. As far as I can tell, typical isn’t defined concretely.

Do the speed estimates mean much? Maybe the industry will settle on norms like, “write 10-50Mbps for LTE download speed regardless of network”. Or perhaps different companies will run with wildly diverging interpretations of the word typical.

Network Management Is Underrated

Network management policies could use more emphasis on the labels. Maybe it would even make sense for each plan to have an entire label about network management. These policies have a huge and underrated impact of performance. As things stand now, the labels will likely only have a link (when online) or a URL (when printed physically) directing to documents about network management policies.

For years, I’ve argued consumers should have better access to information about network management practices. Some of the documents shared by carriers are written in dense legalese that, even once deciphered, is vague about aspects that are impactful for consumers.2 Here’s an excerpt from Verizon’s document:

Looking at the labels from Verizon while considering network management policies further reveals the silliness of the typical speed estimates. Verizon’s Unlimited Ultimate plan includes premium data, which leads to better speeds during congestion. The Unlimited Welcome plan does not. Yet, the two plans show the same typical speeds for 4G LTE and 5G.3

Labels Nail Pricing

The labels do a good job of surfacing pricing information for cell service, including one-time fees. For the minority of plans that bake all taxes and fees into advertised prices, the Fees section provides a place for well-deserved bragging. Unfortunately, the Fees section may not be as illuminating for most plans on the market. When labels are printed (for phone plans sold in physical retail stores), I expect they’ll usually have a vague description in that section: “Varies by location”. On the internet, Verizon allowed me to dynamically generate a label with location-specific information on taxes and fees. I hope other carriers follow suit.

If I could have made one change to the pricing information on the labels, I’d split any ongoing taxes and fees into two sections: (1) location-specific taxes & fees and (2) universal taxes and fees. If a fee applies to every subscriber on a plan, the fee should be shown on labels.

I’m open to changing my mind, but my current view is that regulators ought to push companies to eliminate universal taxes and fees (i.e., bake them into the cost of their plans). Surfacing these fees could be a step in the right direction.

Location-specific taxes probably should be borne by the people living in those locations. As much as I like carriers including taxes in their advertised prices, it gets tricky when some areas have way higher taxes than others (Chicago is a great example of a place with weirdly high taxes on cell phone service). If local taxes are baked into the price of a plan offered at a single price nationwide, people in low-tax areas effectively subsidize people in high-tax areas.