Earlier today, I tried to order Verizon’s 5G Home Internet. According to Verizon’s website, my address was eligible for service.

A few minutes after placing my order, I received an email explaining that my order couldn’t be completed. Here’s an excerpt:

Thank you for choosing Verizon. We were unable to complete the order you recently submitted.

We are sorry, but after further review, it was determined that we are unable to provide home internet service at your address at this time. Prior to qualifying service for any specific location, Verizon evaluates a number of factors to ensure we can provide new and existing customers the best possible experience.

The availability of home internet products may change in the future so we encourage you to stay updated on your eligibility status by visiting https://www.verizon.com/5g/home/ . You can click the “check availability” button and sign up for alerts to stay in the know on when eligibility in your area may change.

According to the FCC’s Broadband Map, my address is eligible. According to the initial screening system on Verizon’s website, my address is eligible. Yet Verizon has some secondary system that quickly and automatically rejected my address. I’m unsure why these different systems are out of sync.

The bit about staying updated on eligibility via verizon.com/5g/home/ isn’t helpful. The info on that page was wrong. That’s why I got far enough to get my rejection email.

Fixed Wireless Availability Conundrums

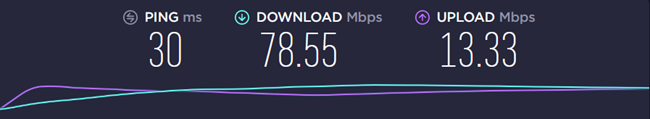

With fixed wireless services like Verizon 5G Home, network congestion needs to be carefully managed. Perhaps Verizon is regularly tweaking the availability of 5G Home Internet based on how much spare capacity the network has in different areas. While tweaking of that sort wouldn’t explain why one of Verizon’s systems clears my address while another rejects the address, it could explain the mismatch with the FCC’s data.

With the FCC only collecting availability data twice per year, recent changes in availability may not be captured. I’m not sure that explains my experience, but it’s a meaningful limitation of the FCC’s Broadband Data Collection, regardless.

It may be rare for a cable internet provider to suddenly decide a region is oversubscribed and reject new subscribers. However, that kind of behavior will be more common for internet providers using technologies that aren’t resilient in the face of congestion (e.g., fixed wireless and satellite). With fixed wireless and satellite internet gaining market share, this problem will become more relevant.