Google Fi brought a lot of innovations and customer-friendly features to the wireless market. I’d argue that Fi’s biggest innovations have been in network switching. Subscribers using “Designed for Fi” phones can automatically switch between coverage from T-Mobile, Sprint, and U.S. Cellular’s networks.

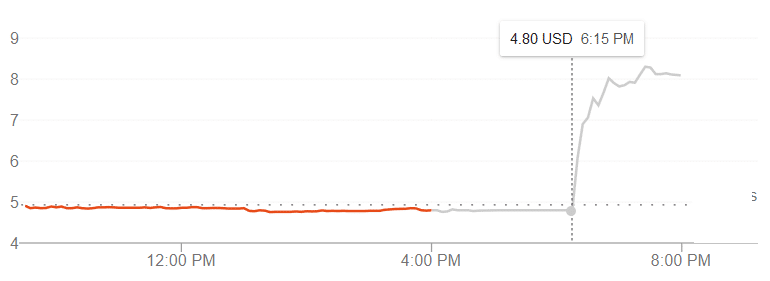

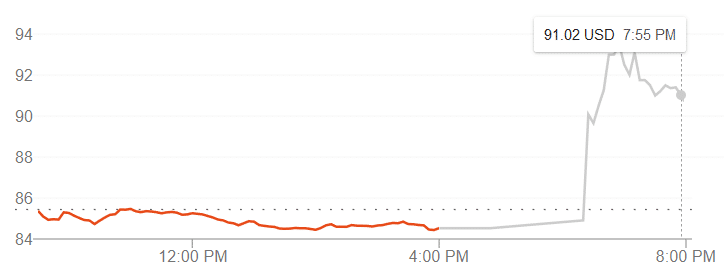

Losing Sprint

Fi’s network switching is about to become a lot less interesting. Sprint’s network will disappear. U.S. Cellular doesn’t have a nationwide network.

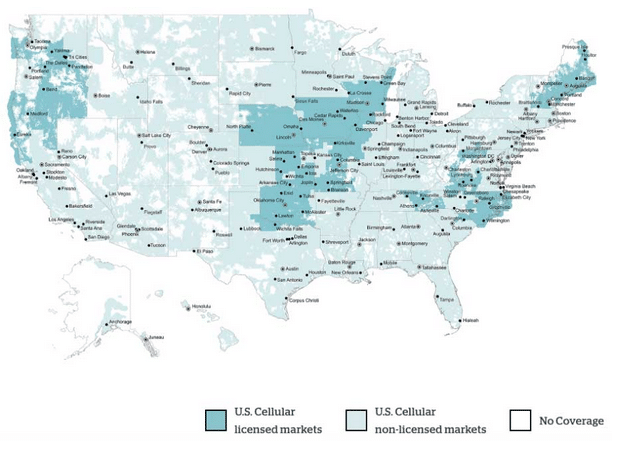

The darker shade in the map below shows where U.S. Cellular’s network is available:1

U.S. Cellular’s network does not cover the majority of the U.S. Once Sprint’s network is gone, Google Fi will be a T-Mobile-based carrier in many places.2

T-Mobile’s network will get better as it integrates Sprint’s assets, so I don’t expect Fi to decrease substantially in quality. However, Fi may become a much less competitive option in comparison to other carriers. There are a lot of carriers that run over T-Mobile’s network. These carriers will also offer better performance as T-Mobile improves its network. Some carriers using T-Mobile’s network are priced much better than Fi. For example, Mint Mobile sells a plan with 8GB of data, unlimited minutes, and unlimited texts for as low as $20 per month. Fi would charge at least $70 per month for the same level of usage.3

I don’t mean to imply Fi will be left in the dust. The carrier offers high priority data, amazing international roaming options, and a user-friendly experience. Many low-cost, T-Mobile-based carriers don’t have those elements. Can Fi convince subscribers that Fi’s premium features justify the service’s price tag?

Will MVNOs get squeezed?

Low-cost carriers may get squeezed by T-Mobile. When Sprint goes offline, MVNOs will have fewer networks they can offer service over. The reduction in options may allow T-Mobile to increase the rates it charges carriers that use T-Mobile’s network.4 While low-cost carriers may have no option but to raise the prices charged to consumers, Fi may be better positioned. Fi is fairly expensive. It’s unlikely T-Mobile would charge Fi so much that Google would struggle to stay in the market.