Helium Mobile is coming out of beta and offering an unlimited plan for $5 per month.1 It’s arguably the cheapest unlimited plan on the US market. But the price is kind of contrived.

Helium Mobile’s Networks

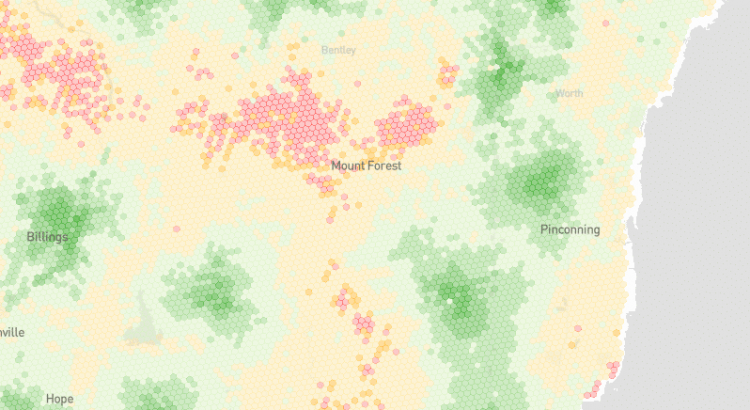

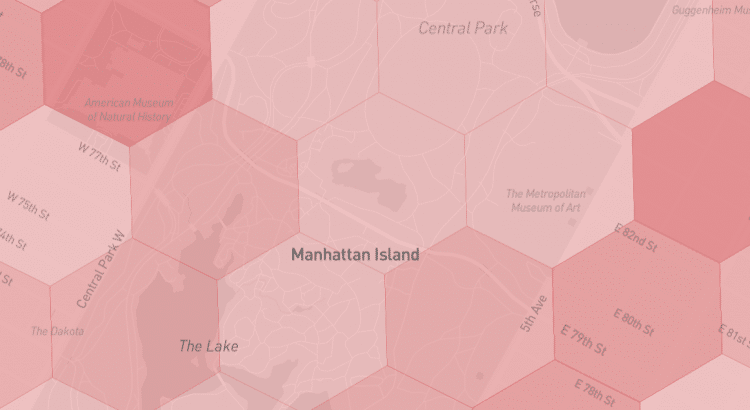

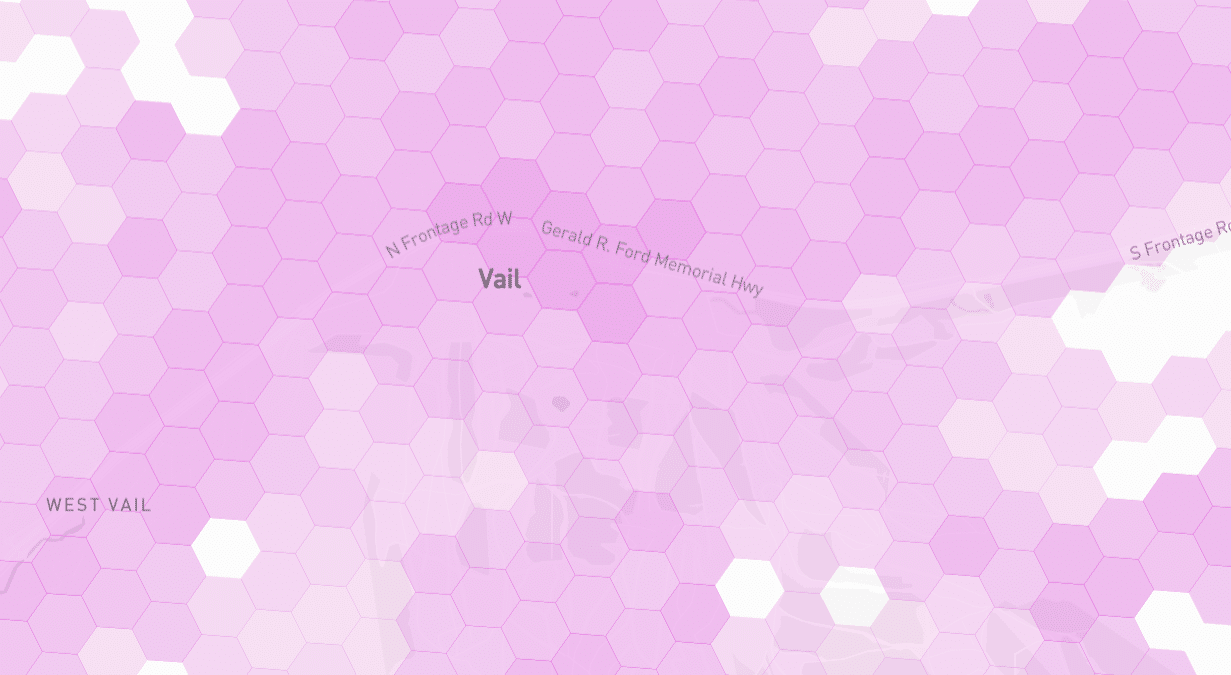

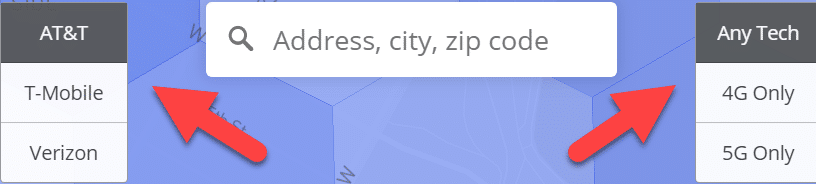

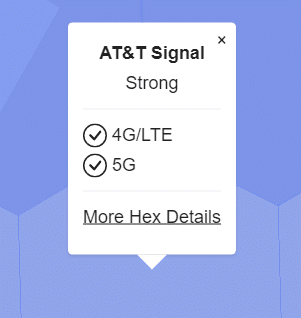

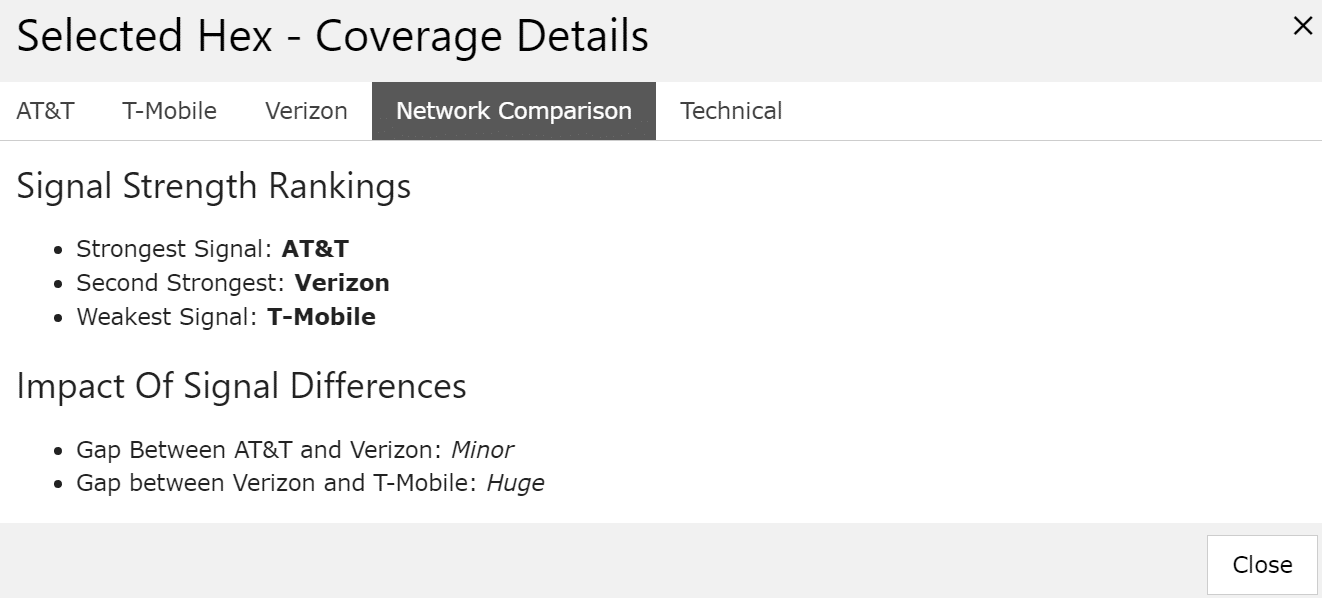

First some background details. Helium Mobile is an MVNO running over T-Mobile’s network. However, the carrier has a novel differentiator. It supplements T-Mobile’s coverage with coverage from Helium’s network of CBRS radios.

The Helium network has roughly 10,000 CBRS radios scattered throughout the country. I won’t get into the weeds here, but Helium got normal people to set up these radios by incentivizing them with the project’s cryptocurrency tokens.

The radios making up Helium’s network are weak and usually poorly located. Helium hasn’t (yet) figured out mechanisms to adequately incentivize good placements. While I don’t know how much area Helium’s network covers, I’m confident it’s far less than 1% of the US by land area.

Currently, Helium Mobile is only accepting signups from people in Miami.2 Helium may be able to build a denser network in Miami than it has in the wider US. But for now, Helium’s coverage footprint within Miami is tiny compared to T-Mobile’s footprint in the city. That will remain true for the foreseeable future.3

How Is Helium Mobile So Cheap?

Nova Labs, the company behind Helium Mobile, raised a ton of money from crypto-adjacent venture capital firms. The $5 price is only possible through subsidization.

It’s normal for new MVNOs to start with prices slightly below their costs while betting that the cost per subscriber will fall after hitting economies of scale.

Helium Mobile is making a bolder bet. At $5 per month, Helium Mobile is taking a huge loss on each subscriber. Helium Mobile is betting on the regular economies of scale while also hoping for a second shift in its underlying cost structure.

While I don’t know the actual numbers, Helium Mobile probably pays a few bucks for each gigabyte of data on T-Mobile’s network. On the Helium network, data comes in at $0.50 per gigabyte. If Helium Mobile gets enough data flowing over Helium’s network, it could achieve a better cost structure than other MVNOs.

Could the cost structure become so good that Nova Labs actually turns a profit on a $5 per month unlimited plan? No. I don’t think that’s Nova Labs’ ultimate goal, though.

A Real-World Crypto Use Case?

Nova Labs’ COO shared this post on Twitter yesterday:

if you are looking for a real world #crypto use case, look no further. $5 unlimited cell plan from @helium_mobile powered by crypto on @helium #hi5 #peoplescarrier 🖐️😉 https://t.co/AC72aFqWFf

— frank 🛡️🎈 (@fmong) August 15, 2023

In my view, the “real world crypto use case” point is aspirational. Or perhaps it has been realized but in a convoluted way. Crypto allowed Nova Labs to raise a bunch of funding. That funding is subsidizing what is, for the moment, a largely conventional cellular service.

Integration Woes

Conventional roaming allows a phone to switch networks when it enters an area where the usual network lacks coverage. I expect Helium wanted to offer something better: seamless coverage with phones intelligently switching between multiple networks serving the same location.

Dynamic network switching of that sort is a technical challenge. It probably takes a lot of buy-in from the networks involved. As far as I can tell, Helium couldn’t pull off this kind of integration with T-Mobile.

For now, Helium Mobile relies on a less streamlined approach. Subscribers must use multiple SIM cards for their service. According to anecdotal reports, handoffs between T-Mobile’s network and Helium’s radios are clunky. For technical and regulatory reasons, Helium’s radios only support data traffic. T-Mobile handles texts and calls.

Scaling Challenges

A $5 price point may attract a lot of customers. More customers means a larger volume of customer support queries. Initially limiting service to Miami may ease the burden of support queries, but I expect Helium Mobile will have to either prioritize building a massive customer support team or settle for a lousy standard.

The Bright Side

While performance issues and integration difficulties plague Helium’s cellular network, there are tractable paths forward. Helium Mobile’s ridiculously low price point may make subscribers more tolerant of bumps in the road as Helium Mobile fine-tunes its service.

Recently, Nova Labs has been teasing an upcoming WiFi product. It’s too soon to say anything confidently, but the product may allow the Helium community to sidestep many of the regulatory and technical challenges cellular presents.

The People’s Network?

Nova Labs’ CEO shared a nice sentiment in a recent blog post:

We believe technology — especially the internet — should be the inheritance of the whole human race. We are all its heirs, and access should be in the hands of the people.