Verizon shared a press release indicating it’s now able to use of all of the C-Band spectrum it purchased licenses for two years ago:

Verizon already deployed a lot of hardware that can use the newly available C-Band spectrum. Improved network quality should hit consumers almost immediately. Here’s another bit from the press release (emphasis mine):

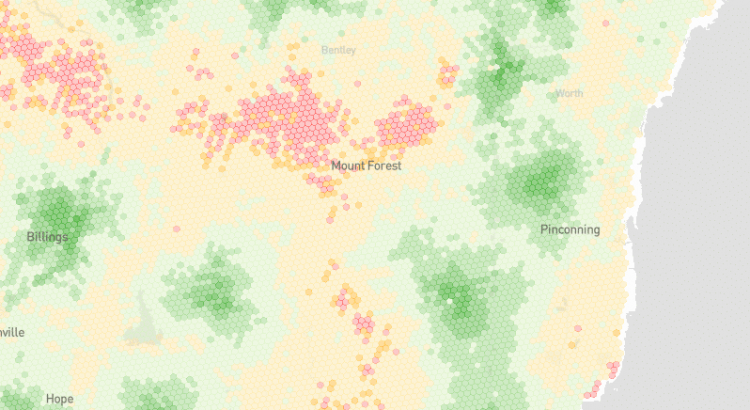

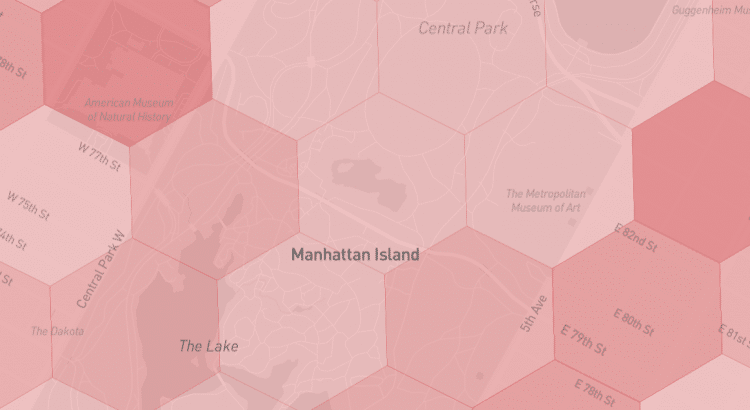

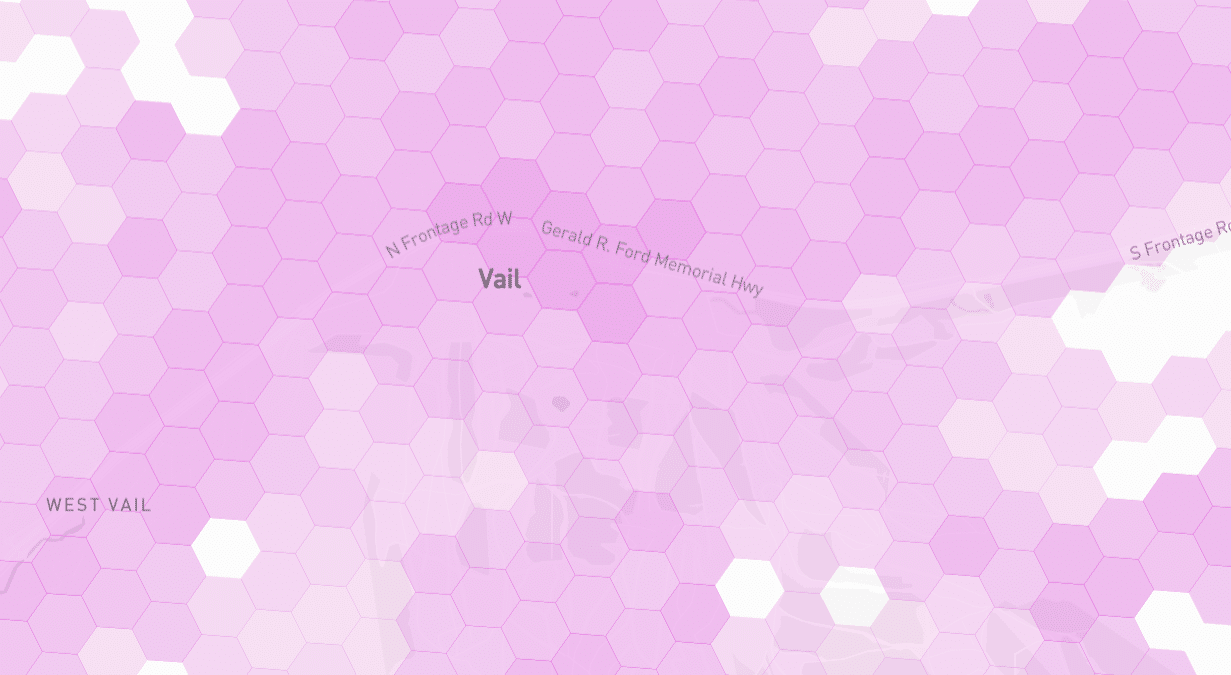

Verizon’s network has increasingly been plagued by congestion issues. I hope the new spectrum will have a material affect on the performance seen by subscribers in some congested areas.